The Central Bank of Nigeria on Wednesday said it would increase the financial capability of young Nigerians to enable them build and accumulate assets to secure their future.

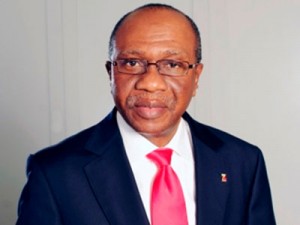

The CBN Governor, Mr. Godwin Emefiele, disclosed this in a keynote address delivered at the Child and Youth Financial Literacy summit held at the bank’s headquarters in Abuja.

The summit, which was part of event to celebrate the 2015 global money week, was attended by children from various schools in Abuja.

The global money week, an initiative of Child and Youth Finance International, is dedicated to the promotion of economic citizenship among children and youths.

Emefiele urged the children to take advantage of the financial literacy programme of the central bank to start planning their future at an early stage.

He said as economic agents, they were expected to be financially capable, know their rights as responsible members of the society, and have the capability to create sustainable means of livelihood for themselves.

The governor said the bank was committed to creating an enabling environment that would produce people that are capable of positively contributing to the economic growth and development of the country.

He said, “Our financial literacy initiatives which specifically targets children and youths is an integral part of this commitment which is clearly demonstrated today as we join the global community in commemoration of the 2015 global money week.

“In our collective effort to empower our teeming population of children and youths, especially those that are vulnerable and marginalised, we must not only increase their financial capability, but also enhance the consciousness of their social and economic rights in building and accumulating assets to secure their future.”

As a signatory to the Maya declaration, Emefiele said the CBN was steadfast in fulfilling its commitment to achieving the target of reducing financial exclusion rate in the country from 46.3 per cent in 2011 to 20 per cent by 2020.

In order to achieve this, he said a financial literacy framework which articulates a strategic direction for a multi stakeholder approach to the delivery of financial education was developed.

The framework, he added, would increase the level of awareness and understanding of financial products and services, enhance the efficient usage of financial resources and empower Nigerians with the knowledge and skills needed to make informed choices.

MMS PLUS NG – Maritime, Aviation, Business, Oil and Gas News Online Newspaper with coverage in Maritime, Oil and Gas, Aviation, Power and Energy as well as Financial News

MMS PLUS NG – Maritime, Aviation, Business, Oil and Gas News Online Newspaper with coverage in Maritime, Oil and Gas, Aviation, Power and Energy as well as Financial News