In October, global manufacturing output faced its fifth consecutive monthly decline, driven by a notable drop in intermediate and investment goods production, although there was some growth in consumer goods. Simultaneously, the service sector experienced its fifth consecutive month of slower expansion, marked by the first contraction in business services in ten months. Consumer services showed minimal growth but reached its weakest level in nine months, while financial services demonstrated strong growth, the best performance since June.

Among 15 nations, including India, Russia, the US, Japan, Brazil, and Kazakhstan, six reported economic expansion, while Europe grappled with economic challenges, leading to contractions in Germany, France, the UK, Italy, and Ireland. Spain’s economic activity remained stable, while mainland China saw little change.

New business levels contracted for the second consecutive month in both manufacturing and service sectors, with only financial services showing growth. International trade also faced ongoing challenges, with new export business declining for the twentieth consecutive month, highlighting the complexities within the global economy. Additionally, global job creation rates reached a nine-month low, with employment in manufacturing declining at its fastest rate in over three years. Both services and manufacturing sectors experienced a reduction in backlogs of work, and business optimism dipped to a ten-month low.

Lastly, price inflation rates eased in October, with lower input costs and output charges, particularly in developed nations compared to emerging markets. The J.P. Morgan Global Services PMI Business Activity Index in October indicated expansion but at the weakest level in the current nine-month period, influenced by reduced new order intakes, declining backlogs of work, and lower business optimism.

Domestic Economy: Soaring prices and currency weakness dampen demand, leading to contractions….

In October, the Nigerian private sector experienced a contraction as soaring input costs weighed on customer demand. Rapidly rising prices discouraged firms from purchasing inputs and caused order completion delays. Despite these challenges, employment continued to rise due to company expansion plans.

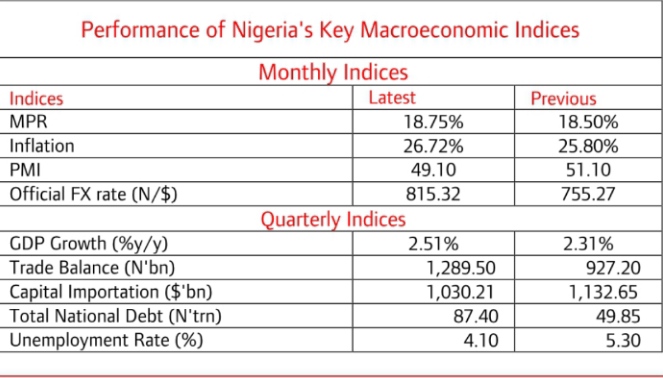

In the month, the headline PMI dropped below 50.0 for the first time in seven months, signaling a deterioration in private sector business conditions at 49.1, down from September’s 51.1. The primary challenge for firms was the sharpest increase in overall input prices in nearly a decade, driven by currency weakness and the removal of fuel subsidies. As living costs, particularly related to transportation, rose, companies increased staff pay considerably. This sharp inflationary environment led to a decline in customer demand in October, ending six months of growth in new business.

Business activity also declined, marking the second drop in three months, and to the greatest extent since earlier in the year. Reduced new orders and high input prices led companies to reduce purchasing activity for the first time in seven months, causing project delays in some cases. Outstanding work increased for the second month, reflecting customer payment delays, despite continued employment growth. Staffing levels rose for the sixth consecutive month, often driven by business expansion plans. While hopes for expansion and new branches supported future output optimism, overall sentiment remained relatively muted. Finally, suppliers’ delivery times improved in October, linked to supplier competition, prompt payments, and less road congestion.

Nigeria’s Economic Recovery Escapes Grasp Amidst Mounting Risks for SSA’s Lost Decade….

The World Bank Group in its October Outlook revised Nigeria’s 2023 growth expectation downward to 2.9% and attributed the revision to lower international oil prices and currency pressures, which are affecting both the oil and non-oil sectors of the Nigerian economy.

Examining Nigeria’s recent economic performance, the report indicates that the country saw a 2.5% year-on-year growth in the second quarter of 2023. Although this represented a slight improvement from the previous quarter, it was notably lower than the 3.5% growth observed in the same quarter of 2022. Economic activities, as evidenced by the Purchasing Managers’ Index (PMI) data for August, remained weak, driven by waning business confidence and rising input costs.

Furthermore, the report highlights that Nigeria’s cash crunch issue, witnessed earlier in the year, began to ease as the central bank extended the deadline for exchanging old naira notes for new ones until the end of the year. This extension supported economic activity, with a 3.6% year-on-year growth in the non-oil economy, particularly driven by the services sector. However, the underperformance of the oil sector continued to hold back overall economic growth, contracting by 13.4% year-on-year.

Taking a broader view of the sub-Saharan African region, the World Bank paints a challenging outlook. It anticipates a slowdown in economic growth for the region, projecting a rate of 2.5% for 2023 compared to 3.6% in 2022. Per capita growth in Sub-Saharan Africa has remained stagnant since 2015, and the region is expected to contract at an average annual rate of 0.1% per capita from 2015 to 2025. The Eastern and Southern Africa subregion is expected to grow at 1.9% in 2023, down from 3.5% in 2022, while the Western and Central Africa subregion is forecasted to achieve 3.3% growth in 2023, down from 3.8% in 2022.

Despite these challenges, the World Bank identified “pockets of resilience” in the region. In 2023, the Eastern African community is expected to achieve a growth rate of 4.9%, and the West African Economic and Monetary Union (WAEMU) is projected to grow by 5.1%. The report also notes that certain countries, such as Benin, Côte d’Ivoire, Ethiopia, Mauritius, Rwanda, and Uganda, have demonstrated economic resilience, with growth rates exceeding 2.5% both before and after the pandemic. However, concerns remain regarding the quality and sustainability of this growth in the future.

Looking ahead to 2024-2025, the World Bank projects an average economic growth rate of 3.7% for Nigeria. This anticipated growth will be driven by key sectors including services, trade, construction, manufacturing, and agriculture. While oil production is expected to recover during this period, it is likely to remain below OPEC+ quotas. Additionally, with the ramp-up in production of a new refinery, fuel product imports are expected to decline.

September records another increase in inflation, reaching 26.72%.

The National Bureau of Statistics published its monthly inflation report for the month of September which showed that Nigeria’s annual inflation rate has continued to surge, reaching an over 18-year high of 26.72% in September 2023, up from August’s 25.8%. This marks the ninth consecutive month of inflationary increases and indicates that headline inflation has risen by 5.94% points on a year-on-year basis compared to the 20.77% recorded in September of the previous year. This suggests a gradual increase in the inflation rate over the past twelve months.

The report points in details how various factors contributed to the headline inflation’s acceleration at the divisional level. As such, key drivers include food and non-alcoholic beverages, which experienced an uptick from 13.36% in August to 13.84%. Housing and utilities also saw a slight increase from 4.32% to 4.47% in August 2023. Health inched up by 2 basis points to 0.8% from the previous month’s 0.78%, while transport and restaurants and hotels exhibited similar patterns of acceleration, standing at 1.74% and 0.32% respectively. Additionally, clothing and footwear experienced a minor increase from 1.97% to 2.04%, and miscellaneous goods and services rose from 0.43% in August to 0.44% in September 2023.

Of particular note is the substantial influence of the food index, which has been the primary driver of the mounting pressure on headline inflation. It recorded a slower increase, with a 130-basis point rise to 30.64% year-on-year in September, compared to a 2.35%-point increase to 29.34% year-on-year the preceding month. Imported food inflation, another significant contributor, surged by 1.55% points to 21.72% year-on-year, surpassing the prior month’s rise of 23 basis points to 20.17% year-on-year. This spike is attributed to elevated prices for items like oil and fat, bread and cereals, potatoes, yam, fish, fruit, meat, vegetables, milk, cheese, and eggs.

The annual core inflation rate, which excludes farm produce, further intensified to 22.1% in September, quickening from 21.2% in August. This acceleration underscores the continued build-up of underlying inflationary pressures in the Nigerian economy. The surge can be linked to the swifter pace of inflation in clothing and footwear, as well as price increases in passenger transport by road, passenger transport by air, medical services, and the repair and maintenance of personal transport equipment.

FX Woes, Policy Mismatch Still Clogs Nigeria’s Foreign Investment Pipelines

The National Bureau of Statistics report revealed a concerning trend in foreign investment within Nigeria with total capital importation dropping by 32.90% y/y to $1.03 billion, down from $1.53 billion during the same period in 2022. This figure also fell short by 9.04% when compared to the previous quarter, which recorded $1.13 billion in investments. This is a significant cause for concern as it represents the lowest level since Q1 of 2016, indicating systemic issues and a lack of coherent policies that are obstructing the inflow of investment into the country.

Notwithstanding, a closer examination of the report reveals that the category of “Other Investment,” which includes loans, trade credits, and other investments, accounted for the lion’s share at 81.28% ($837.34 million). This was largely influenced by a staggering 146,328% quarteron-quarter increase in other claims, amounting to $65.81 million, and a 77.82% quarteron-quarter surge in total loans, reaching $771.53 million. In contrast, trade credits and currency deposits saw minimal investment during this period. Portfolio Investment, encompassing equity investments and debt securities, comprised 10.37% ($106.85 million) of the total, and it faced pressure due to a significant downturn in the money market (-89.6% q/q and -96.9% y/y) and bonds (-71.6% q/q and -73.5% y/y) investments, exacerbating the trend of hot money exiting the market. The equities market also suffered pessimism (-96.2% q/q and -33.0% y/y) and attracted only $8.5 million. Foreign Direct Investment (FDI), accounting for 8.35% ($86.03 million) of total investments, saw an 80.7% quarter-on-quarter improvement but remained insufficient to drive positive year-on-year growth. Consequently, FDI, comprising 8.4% of the total, plummeted by 41.5% year-on-year, with sub-components such as Equity (-39.5%) and Other Capital (-99.7%) displaying weakness.

Within sectors, Manufacturing/Production emerged as the top recipient, attracting $605.4 million, which accounted for 58.7% of the total investment. This marked a significant increase compared to $256.1 million and $234.0 million in the first quarter of 2023 and the second quarter of 2022, respectively. Apart from financial services, other sectors experiencing positive inflows included Agriculture ($10.0 million), Trading ($46.6 million), and Telecoms ($25.8 million). Notably, non-financial activities represented 68.3% of the overall inflows, a substantial improvement from 54.8% in the first quarter and 37.1% in 2022. This indicates that financial flows may have been more severely impacted than physical capital importation amid the ongoing economic challenges.

Geographically, Ogun State witnessed an increase in capital inflows to $24.0 million, up from $2.1 million in the first quarter, and it recorded no inflows throughout 2022. Similarly, Akwa-Ibom enthralled with a 6.5x growth in capital imports, reaching $33.9 million compared to the first quarter, accounting for 79.6% of its entire 2022 inflow. In contrast, Abuja experienced a 52.6% decline in flows, while Lagos saw a modest 10.4% boost. These two regions accounted for a significant 94.4% of the country’s total inflow, underscoring the challenges faced by sub-national economies and emphasizing the need to enhance the appeal of other states. In the second quarter of 2023, only 5 out of the 36 states and the Federal Capital Territory (FCT) managed to attract foreign investment flows, a clear indication of the concentration of investments.

Nigeria’s Foreign Exchange Reserves: A Yo-Yo of Fluctuations and Surprises in 2023……

According to the official data from the CBN, Nigeria’s foreign exchange reserves, a once-robust bulwark against economic shocks, have dwindled by $3.8 billion which is around 10.2% in recent months, like a mighty river running dry to $33.31 bill. This is the lowest level for the reserve since July 2021 when it hit a low of $33.09 billion.

Nigeria’s inability to reap from the windfall that hit the global oil market following the geopolitical unrest in the east of Europe since February of 2022 has taken a tow on the economy as well as the lack of dollar liquidity within the central bank’s vault to defend the naira. This, however, has led to the apex bank relying on the reserves for its continued defense of the local currency in the foreign exchange market. Thus, we can say that the steady decline in gross official reserves, coupled with fx liquidity constraints has resulted in a weakening of investor confidence and a general loss of appetite by the offshore community.

Notwithstanding, we can point fingers to a number of factors behind this decline. One is the rising cost of imports, driven by factors such as the war in Ukraine and supply chain disruptions. But a first glance at the total reserves as at mid-October 2023 portends that it can cover about 8 months of merchandise import on the basis of the balance of payments for the 12 months to Dec ’22 and almost 7 months when we add services. Meanwhile, FMDQ’s data shows that monthly transactions on the investors’ and exporters’ (I&E) fx window for 9M 2023 are currently running at an average of $2.1 billion, compared with $2.4 billion over the comparable period of 2022.

In August 2023, JP Morgan, a significant player in managing Nigeria’s external reserves, released a report that offered insights into the country’s net reserve position. According to their estimations, Nigeria’s net reserve position was approximately $3.7 billion. This calculation was arrived at by adjusting the gross reserve figure at the end of 2022, which was $37 billion, to account for several factors:

– JP Morgan estimated that outstanding off-balance sheet swaps amounted to $21 billion. These swaps likely represent financial arrangements or agreements between the Central Bank of Nigeria (CBN) and various entities, which impact the actual net reserve position.

– An estimated $7 billion in on-balance sheet FX forwards were considered in the calculation. These forward contracts may involve commitments to exchange currencies at specified future dates, affecting the overall reserve position.

– Securities lending obligations of $5.5 billion were factored in. This suggests that the CBN may have engaged in securities lending activities, potentially impacting the reserve position.

It is worth noting that the report also mentioned that the swap data was consistent with an estimated non-public figure for outstanding Open Market Operations (OMO) obligations issued by the CBN to Nigerian banks and other financial institutions. This figure was stated as N9.8 trillion, which is approximately $21.2 billion when converted. These OMO obligations likely played a significant role in the adjustments made to the gross reserve numbers.

Domestic Equities Market: Market Sustains Bullish Outing on Impressive Corporate Releases; Investors Gain N1.7trn…

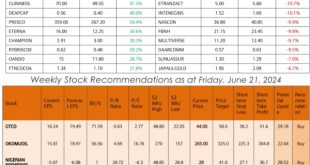

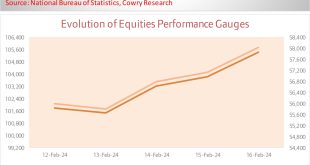

The local stock market continued its positive momentum, which has been ongoing since May, with the benchmark index approaching historic levels close to 70,000 points. In October, the All-Share Index (ASI) recorded a 4.30% month-on-month gain, reaching 69,236.19 points. This impressive performance was attributed to strong corporate earnings for the third quarter, interim dividend declarations by corporations, and an overall sense of market optimism. The market capitalization of listed equities also experienced a significant increase, rising by N1.7 trillion to N38.04 trillion during the month. The year-to-date return for the market stood at 35.09%.

However, trading activity weakened in October, with both average trading volume and value declining. Average trading volume dropped by 40.0% to 336.9 million units, while average trading value decreased by 29.6% to ₦5.2 billion. Notable stocks such as FIDELITYBNK, ACCESSCORP, and UBA were the most traded stocks by volume, while GTCO, ACCESSCORP, and UBA led in terms of the most traded securities by value.

Regarding sector performance, four out of five sectors closed positively during the month. The Banking sector led the way with a 7.54% month-on-month gain, driven by strong performances in UBA, FIDELITYBNK, ACCESSCORP, and ZENITHBNK. The Industrial Goods, Oil & Gas, and Consumer Goods sectors also posted gains of 6.54%, 2.38%, and 1.48%, respectively, with notable contributions from companies like BETAGLASS, BUACEMENT, AIRTELAFRI, DANGSUGAR, OANDO, and NESTLE. In contrast, the Insurance sector recorded a 1.61% month-on-month decline, primarily due to adverse price movements in PRESTIGE, SUNUASSUR, NEM, and CUSTODIAN.

At the close of the month, top performing stocks for the month were THOMASWY (110.4%), CHAMS (69.5%), IKEJAHOTEL (59.6%), UBA (19.6%) and AIRTELAFRI (19.4%) while the least performers for the month includes OANDO (26.6%), PRESTIGE (18.00%), ELLAHLAKES (17.65%), CADBURY (13.9%) and MCHNICHOLS (12.3%).

Foreign Exchange Market: Naira Depreciates Across FX Markets as Demand Pressure Holds Sway….

Nigeria’s foreign exchange market in October 2023 was characterized by continued depreciation of the naira against the US dollar, increased intervention by the CBN, and the introduction of new foreign exchange rules in a bid to improve liquidity level in the month. Regardless of the increased intervention by the CBN and the introduction of new foreign exchange rules, the naira continued to depreciate against the US dollar in October 2023.

To start with, the global oil market experienced a series of fluctuations in October 2023, with prices oscillating between $80 and $100 per barrel. The month began on a bullish note, with oil prices surging to a peak of $100 per barrel as the World Bank projects a $150 per barrel by December. However, concerns about a potential global economic recession cast a shadow over the market, leading to subsequent price declines.

One significant development in the oil market during this turbulent month was the announcement made by OPEC+, revealing plans to implement a production cut of 2 million barrels per day, a move aimed at providing support for oil prices in the face of economic uncertainties. This decision was closely watched by market participants, as it underscored the organization’s continued efforts to stabilize oil markets. Despite this intervention, oil prices faced headwinds in the final week of October as strengthening US dollar and profit-taking by investors contributed to a decline in oil prices.

On the domestic front, there was a positive development in Nigeria’s economic landscape as the crude oil production witnessed a remarkable 14.1% m/m uptick in October, reaching 1.35 million barrels per day (mbpd), marking the highest output level in 20 months. The surge in crude oil production was further bolstered by the stability of global crude oil prices, which remained above the $80.00 per barrel mark. This combination of increased output and favourable global oil prices played a pivotal role in bolstering Nigeria’s foreign reserves balance which exhibited a 0.3% m/m improvement, concluding at $33.4 billion for the month of October.

Meanwhile, amidst the trail of events, the naira depreciated against the US dollar in October 2023, across various FX segments, trading at historic high of N1300/$ on the parallel market as speculative demand stayed unabated. In context, at the official FX market, the naira skidded by 7.95% (N60.05) m/m to close at N815.32/$1 while it further depreciated by 16.7% m/m (N168.00) at the parallel market to N1,176/$1 at the close of October.

In a related development, during the month, the Central Bank of Nigeria (CBN) emphasized its dedication to maintaining orderliness and professionalism among participants in the Nigerian Foreign Exchange Market. This commitment is aimed at allowing market forces to determine exchange rates through a “willing buyer – willing seller” approach. Furthermore, the CBN stresses the importance of referencing Foreign Exchange (FX) rates from reliable platforms like the CBN website, FMDQ, and other recognized trading systems to enhance transparency, credibility, and price discovery in FX rates.

In its efforts to uphold price stability, the CBN will inject liquidity into the Nigerian Foreign Exchange Market through occasional interventions, gradually reducing them as market liquidity improves. Importantly, the CBN has now granted importers of the 43 items previously restricted in the 2015 Circular the ability to purchase foreign exchange in the Nigerian Foreign Exchange Market. Additionally, the CBN is actively working to clear the FX backlog and is in continuous dialogue with stakeholders to address this issue. The CBN has also set its sights on establishing a unified FX market and is currently engaging in consultations with market participants to achieve this objective.

Money Market: Yields experience a sharp increase due to ongoing liquidity constraints.

In October, the system liquidity in the financial markets of Nigeria faced a deficit of N557.7 billion, primarily due to two key factors. First, the lifting of restrictions on the Central Bank of Nigeria’s (CBN) Standing Deposit Facility (SDF) contributed to a decrease in available funds within the system. Second, there were net sales of N622.7 billion worth of Open Market Operations (OMO) and Nigerian Treasury bills (NT- bills), further tightening liquidity conditions.

As a result of these market dynamics and the scarcity of available funds, both the Official Policy Rate (OPR) and Overnight (OVN) rates experienced significant increases. The OPR surged by 12.9 percentage points to reach 15.6%, while the OVN rate increased by 13.1 percentage points, reaching 16.5%. These elevated rates reflect the challenges faced by market participants in accessing and managing funds in the constrained liquidity environment.

Elsewhere, the Central Bank of Nigeria (CBN) conducted two rounds of Treasury bills (T-bills) auctions in the month of October, with a total offer of N144.7 billion, representing a significant 73.4% decrease from the previous month’s level. This reduction in the offer size caught the attention of market participants as demand for T-bills saw a noticeable increase, leading to a bid-to-offer ratio of 6.6x in October, compared to 4.3x in September. Meanwhile, the surge in demand was particularly evident for the 364-day T-bill instruments, where the bid-to-offer ratio improved from 4.3x to 7.2x, with an offer size of N128.1 billion. On the other hand, the 91-day T-bills (N5.6 billion offer) and 182-day T-bills (N11.0 billion offer) recorded bid-to-offer ratios of 2.8x and 2.2x, respectively, showing a slight decrease from the previous month’s ratios of 3.3x and 3.8x.

Compared to the prior month when the CBN sold the exact amount offered, October’s auctions saw an over-allotment of 181.2% across all T-bill instruments suggesting heightened investor interest and appetite for government securities. During the final auction of the month in October, the stop rates on T-bills saw an increase. The stop rate for the 91-day T-bill rose to 6.0%, the 182-day T-bill had a stop rate of 9.0%, and the 364-day T-bill recorded a stop rate of 13.0%. These rates were higher than the rates observed in September, which were 5.0%, 6.6%, and 11.4%, respectively. The rise in stop rates reflects changing market conditions and the influence of supply and demand dynamics on T-bill pricing.

In the secondary market for Treasury bills (T-bills), there was a significant uptick in average yields during the month, with a notable increase of 3.1 percentage points month-on-month, bringing the average yield to 11.4%. Several factors contributed to this surge in yields, including a hawkish stance in the money market and constrained liquidity conditions. The pressure to sell T-bills was most pronounced in the 91-day instrument, where yields increased by 3.9 percentage points. This was followed by the 364-day and 182- day T-bills, which saw yields rise by 2.7 percentage points. The increased yields reflected the market’s response to the prevailing monetary and liquidity conditions.

Bonds Market: Sell-off sentiment dominates FGN bonds, while Eurobonds show gains.

In the Secondary Bond Market, persistent sell pressure had a negative impact on bond performance, resulting in an increase in average yields across tenors, indicating that investors were demanding higher returns in response to prevailing market conditions. Comparing the monthly market activities, average yields rose by 88 basis points (bps) to reach 15.3% in October from 14.44% in the prior month. This increase was driven by an uptrend in yields across the short, mid and long dated tenors, reflecting the bearish market dynamics during the period.

During the October edition of the primary auction of the FGN (Federal Government of Nigeria) bonds conducted by the Debt Management Office (DMO), the agency offered its standard N360 billion worth of FGN bonds to investors. Although they fell slightly short of their sales target at N335 billion, this result marked a significant improvement compared to the two previous auctions. The sales-to-offer ratio, which reached 0.9x, showed notable growth from the 0.7x and 0.6x recorded in September and August 2023, respectively.

Total subscriptions amounted to N383 billion, representing a bid-to-cover ratio of 1.1x, slightly below the 1.2x recorded at the previous auction. Yields moved upwards compared to the previous auction, indicating a conventional yield curve across the four available bond instruments. The marginal rates for the 5-year (April 2029), 9-year (June 2033), 14-year (June 2038), and 29-year (June 2053) bonds closed at 14.9%, 15.75%, 15.8%, and 16.6%, respectively, marking an average increase of 33 basis points relative to the previous auction. Similar to the September 2023 auction, investor demand was strongest for the longest tenor on offer, the 29-year June 2053 maturity, which was oversubscribed with a sales-to-offer ratio of 2.63x to reflect investor sentiment and demand for government bonds in the Nigerian market.

The Eurobond market displayed a positive performance in October, reversing the previous month’s negative trend. This improvement was driven by robust buying interest and renewed investor confidence across all maturity periods. These factors collectively pushed the average yield in the market lower, decreasing by 43 basis points month-on-month to 11.40% at the end of October, down from 11.83% in the prior month. This positive turn in the Eurobond market reflects the improved sentiment and attractiveness of Eurobond investments to investors during the month.

MMS PLUS NG – Maritime, Aviation, Business, Oil and Gas News Online Newspaper with coverage in Maritime, Oil and Gas, Aviation, Power and Energy as well as Financial News

MMS PLUS NG – Maritime, Aviation, Business, Oil and Gas News Online Newspaper with coverage in Maritime, Oil and Gas, Aviation, Power and Energy as well as Financial News