As Nigeria’s export rate is nothing compared with the rate of exportation of goods, the government is doing everything to make sure that exportation business thrives in the country. These are some of the procedures required to venture into the business of exportation in Nigeria. Get educated as you read.

All goods (including oil/its derivatives and non-oil goods) exported from Nigeria shall be subject to inspection by Inspection Agent(s) appointed for that purpose by Government. All exports exempt from inspection by the Inspection Agent(s) are listed in SCHEDULE “A” appended. For the avoidance of doubt, goods prohibited for exportation from Nigeria as contained in the annual Fiscal Policy guidelines shall not be processed by the Inspection Agents.

Goods on the current Export Prohibition list are detailed in SCHEDULE “B” appended. The Inspection Agent(s) shall inspect the quality and quantity of all exports as well as the true value of goods to the consignee and shall issue a Clean Certificate of Inspection (CCI) in respect of such goods within 72 hours after the inspection of the goods.

However, where a written complaint or protest has been lodged by the consignee or his agent on oil and gas exports, the relevant CCI shall be issued within a maximum period of 30 days. In the event of uncovering discrepancies that cannot be corrected immediately, the exporter shall be issued with a “Non-Negotiable Certificate of Inspection” (NNCI). It is however in the interest and integrity of the exporter to correct the discrepancies to enable the Inspection Agent(s) issue the appropriate certificate and endorse the commercial (final) invoice accordingly.

Exporters shall open a domiciliary account with any bank in Nigeria and this same bank shall issue the Exporter with a Nigerian Export Proceeds Form (NXP Form) in sextuplicate for completion in respect of each export transaction, The Exporter shall ensure that the export proceeds are credited to this account. Having collected a set of NXP Form from his/her bank, the Exporter completes the Form in sextuplicate, and returns same to the bank with a contract of sale or proforma invoice. The bank shall register and endorse same and retain the original copy. The remaining five copies shall be forwarded to the Inspection Agent(s)

The Exporter shall retain a photocopy of the NXP Form and use the NXP number as reference in all dealings with his bank, Central Bank of Nigeria, Inspection Agents and Nigeria Customs Service. The NXP Form shall be utilized within six months from the date of registration, subject to renewal for three months by the dealing bank. Subsequent requests for renewal are to be approved by the Director, Trade and Exchange Department, Central Bank of Nigeria, Abuja otherwise it must be returned to the exporter’s banker for cancellation.

The exporter shall be required to pay to a designated bank, the Nigerian Export Supervision Scheme (NESS) Administrative charge of 0.5% and 0.15% of FOB value of the intended non-oil and oil/gas exports, respectively. The designated bank shall remit this to the NESS fee account in the Central Bank of Nigeria (CBN), If after inspection, the FOB value is found to be higher than that declared, then additional NESS fee shall be paid by the exporter accordingly.

Having completed the NXP Form, the exporter shall collect a REQUEST FOR INFORMATION (RFI) Form from the Inspection Agent or download from the Inspection Agent’s website. The purpose of the RFI Form is to enable the inspection company to coordinate with the exporter, a suitable time and place for the physical inspection. It is therefore essential that exporters provide in the RFI, all the required information promptly.

The completed RFI shall be submitted to the Inspection Agent(s) along with all relevant documents relating to the export transaction. For oil/gas exports, the exporter shall also collect a BILL OF LADING DECLARATION FORM from the Inspection Agent(s) or download from the Inspection Agent’s website which shall be completed after loading and thereafter submitted to the Inspection Agent(s). Upon receiving the relevant documents, the Inspection Agent(s) shall open a file accordingly.

Any person intending to export any goods from Nigeria shall give notice of not less than 10 working days to the Inspection Agents prior to shipment. The inspection shall take place at the seaports, airports, terminals, or other points of dispatch or at the point of production and/or storage. The exporter shall provide necessary logistics, such as ladder, fork lift trucks, labour, etc to enable the Inspection Agent(s) perform their quality/quantity inspection and pricing analysis.

Where exports involve processed food, drugs, animals or plants, crude oil, liquefied natural gas, liquefied petroleum gas, condensate, Dual Purpose Kerosene (DPK), lubricants and grease, the necessary Government Agencies shall be invited for certification. In the case of oil and gas exports, there shall be final joint inspection by the Inspection Agent(s), Nigeria Customs Service (NCS), the Department of Weights and Measures of the Federal Ministry of Commerce and Industry and Department of Petroleum Resources (DPR). Exporters should note that, units of measurement with respect to quality and quantity determination in the oil and gas industry are unique and should be appropriately reflected on the NXP Form. Having carried out the inspection, the Inspection Agent(s) shall complete their respective section of the NXP Form, retain the second copy and forward the remaining four copies to the Nigeria Customs Service.

After completing their respective section, the Nigeria Customs Service shall retain the third copy and distribute the remaining three copies as follows: Fourth copy to Central bank of Nigeria. Fifth copy to Nigerian Export Promotion Council (NEPC) in case of non-oil exports or to the Department of Petroleum Resources (DPR) in the case of oil and gas exports. Sixth copy to the exporter. (The exporter shall make a photocopy and submit to this bankers to update their records). The Inspection Agent(s) shall ensure the quality, quantity and the value of the goods to be exported to the consignee and shall, if satisfied, issue a Clean Certificate of Inspection (CCI) in respect of such goods.

The CCI shall comprise eight (8) original copies which shall be distributed as follows:

a. 1st Original to Exporter

b. 2nd to Exporter for his bank

c. 3rd to Exporter for ship/freight Agents.

d. 4th copy to Nigerian Export Promotion Council (NEPC) or Department of Petroleum Resources (DPR) for non-oil or oil/gas exports, respectively.

e. 5th copy to Nigeria Customs Service (Area Comptroller at the Port of shipment)

f. 6th to Federal Ministry of Finance

g. 7th to Central Bank of Nigeria,

h. 8th to Nigeria Ports Authority/Federal Airports Authority of Nigeria.

A certified true copy each to Nigeria Customs Service (Headquarters), Bureau of Statistics (BOS) and Weights and Measures Department of the Federal Ministry of Commerce and Industry. In the event of any queries, the exporter shall be contacted for explanations. Exporters should be aware that once goods have been inspected and CCI issued, any variation between goods presented for loading and those confirmed by the CCI will render the Exporter liable to penalties in accordance with the Laws of the Federal Republic of Nigeria.

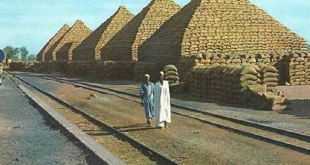

For the release of Agricultural Commodities for Export from Registered Produce Warehouse/Port of Export, the following conditions must be met:

- Evidence of quality inspection; and Certificate by the Federal Produce Inspection Service (FPIS) or by relevant government agency.

- No loading of any export cargo into sea-going vessels or aircraft shall be authorized without the issuance of a “Clean Certificate of Inspection” (CCI) by Inspection Agent(s).

- Repatriation of Export Proceeds: Within 90 days from the date of export, all exporters (whether oil, gas or non-oil) shall ensure that the export proceeds are repatriated and credited to their domiciliary account opened with a bank in Nigeria. It is the responsibility of the Central Bank of Nigeria to monitor the repatriation of all export proceeds.

- Letter of Credit (LC), bill of collection, advance payment and/or other approved international modes of payment shall be accepted for all exports from Nigeria.

- The Exporter shall submit the Single Goods Declaration Form to the Nigeria Customs Service without which no exportation shall take place.

- The Nigeria Customs Service shall submit to the Director, Trade and Exchange Department, Central bank of Nigeria monthly, shipment copies (Fourth copy) of the NXP Form to cover that period’s export transaction.

- The Federal Ministry of Transport shall issue circular letters to shipping companies/carriers not to carry Non-CCI exports which by regulation should be accompanied by the document. Defaulting shippers/carriers shall be duly sanctioned.

- The Inspection Agents shall submit monthly, quarterly and annual statistical returns on the export transactions to the Federal Ministry of Finance, Central Bank of Nigeria, Federal Ministry of Commerce and Industry, Bureau of Statistics, Office of the Secretary to the Government of the Federation and Nigeria Customs Service.

For the Pre-shipment Inspection of Oil and Gas Exports, the modalities of operations shall be as follows:

- Quality Inspection:

- The Terminal Operator shall inform the Inspection Agents of all scheduled lifting and shall also provide the inspector with all relevant details relating to vessel(s) nomination;

- The Inspection Agents shall participate in the entire fiscalisation and defiscalisation processes at the export terminals (Land based, Floating Production Storage and Offtake (FPSSO) and Floating Storage and Offtake (FSO), as members of the team charged with those responsibilities at the terminals.

- Quantity Inspection :

- The Pre-shipment Inspection Agent (PIA) shall generate and compute own data independently, as other members of the fiscalisation and defiscalisation team, using approved standards, guidelines and procedures.

- All parties that participate in the fiscalisation and defiscalisation processes shall reconcile their independently generated data with the Terminal Operator and the DPR prior to certification (Certificate of Quantity).

The fiscalisation/defiscalisation team shall include the representatives of the Terminal Operator, PIA, Nigeria Customs Service (NCS), Weights and Measures Department Federal Ministry of Industry, Trade and Investment), DPR and independent cargo surveyors appointed by the buyer.

SCHEDULE ‘A’ EXPORT GOODS EXEMPTED FROM INSPECTION –

- Personal effects

- Used motor vehicles

- Perishables i.e. day old chicks, human eyes, human remains, vaccines, yeast.

- Periodicals / magazines

- Object of art

- Explosives

- Pyrotechnic products

- Arms

- Ammunition

- Weapons

- Implements of war

- Live animals

- Household and other non-commercial products including: Gifts and personal effects,

- trade samples/printed business matter, machineries and equipment for repairs abroad, machinery for the execution of specific contract, re-exports, Return of empty containers.

- Trans-shipments and Supplies to Diplomatic/Consular Missions and supplies to UNO for their own needs.

MMS PLUS NG – Maritime, Aviation, Business, Oil and Gas News Online Newspaper with coverage in Maritime, Oil and Gas, Aviation, Power and Energy as well as Financial News

MMS PLUS NG – Maritime, Aviation, Business, Oil and Gas News Online Newspaper with coverage in Maritime, Oil and Gas, Aviation, Power and Energy as well as Financial News