FG targets 10 per cent equity in new national carrier

• Scales up take-off fund to N47b

The Federal Government (FG), may have as much as 10 per cent stake in the new national carrier christened, Nigeria Air.The equity, already backed with at least N47 billion take-off fund in the 2019 budget, is to boost the morale of intending investors in the project.

The Guardian learnt that the proposed airline, now in the procurement phase, will debut this year, as soon as reputable foreign investors and technical partners come onboard.

Recall that the Government budgeted N47 billion for the new national carrier in the 2019 budget recently signed into law. The latest figure was an upscale from N8.7 billion initially proposed for the project in the 2019 Appropriation Bill, and N3.2 billion originally planned as part-payment of FG’s five per cent stake in the proposed airline.

A source in the Ministry of Transportation said the government was working towards a 10 per cent equity and not the earlier five per cent stake. “It is a national airline and we need to match words with the right action, telling the world that we are indeed ready to take it off the ground.

“Government knows that it must be supported with a sizable take-off fund to attract investors, and I can assure you that investors are now showing better interest than we earlier saw,” the source said. Recall that the FG had in July 2018, unveiled the name and logo of the proposed national carrier, Nigeria Air, at the Farnborough International Public Air show in London, ahead of the initial take-off on December 24.

As contained in the Outline Business Case (OBC) approved by the Infrastructure Concession Regulatory Commission (ICRC), the airline is a Public Private Partnership (PPP), with 95 per cent share pushed to investors while the government initially planned to own just five per cent stake.

To get the new national carrier off to a start, the Government was to inject the sum of N3.168 billion ($8.8 million) as startup capital of the Nigeria Air. The Guardian gathered that the initial injection of N3.2 billion startup fund is part-payment of government’s five per cent equity in the investment, whose take-off fund in the next three years of operation was put at N108 billion ($300 million).

Shortly after the London launch, the airline, however, became a hard sell to quality foreign investors and technical partners, amid smear campaigns coming from the streets. The Guardian learnt that although a number of bids were received across the board, they were from carriers that are either struggling to earn profit or from main competitors that the Nigeria Air was to compete with.

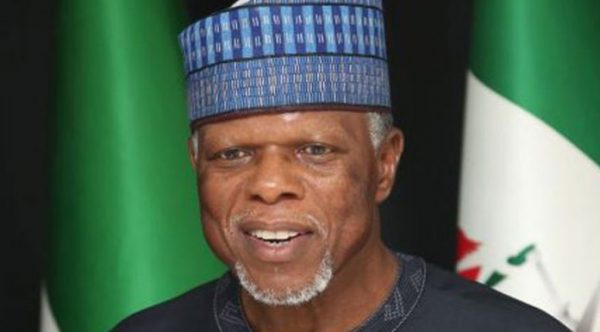

The last spanner in the works came from the Federal Executive Council meeting, where about four but very strong members voted nay for the December 24 take-off of the new carrier. Preference of the big wigs was a 2019 launch and notwithstanding their number, they carried the day, forcing the former Minister of State for Aviation, Hadi Sirika, to announce indefinite suspension of the national carrier.

The former minister has, however, kept hope alive that the set-back was only temporary as Nigeria Air will take-off in 2019. Sirika at a recent stakeholders’ meeting in Lagos still reassured that the national carrier, airport concession, Maintenance Repair and Overhaul (MRO) facility, aircraft leasing company and aerotropolis, were in development or procurement phases toward their set-up.

Secretary-General, the Aviation Security Round Table Initiative (ASRTI), Group Capt. John Ojikutu (rtd), said the new budget for Nigeria Air was a step in the right direction, given the huge capital required for such projects. Ojikutu said N47 billion is just about $130 million, and “just enough to buy three fairly-used medium range aircraft.

“A new national carrier would need about about $1.5 billion or N540 billion to buy at least 10 mixed aircraft of short, medium and long ranges. If you can imagine that Air Peace bought each of its B777 for $122 million or N43 billion, you can then imagine what it would cost to set up a national carrier with at least 10 aircraft, and at least two B777.

“N47 billion to me is a little less than 10 per cent of the expected holdings of the airlines. Former minister said at the last forum that government would not have more than 10 per cent shares. The remaining, I presume would come from foreign technical investors/partners, Nigerian investors and the public through the capital market.

“My presumption of 10 per cent for governments included the 36 States governments’ five per cent and Federal Government’s five per cent. National carrier is not a federal nor states governments’ carrier, but governments, private and public airline,” Ojikutu said.

Chief Executive Officer, Beljune Consult, Chris Aligbe, reiterated his believe in a national carrier with government’s sovereign cover of 10 to 15 per cent equity, and not five per cent. Aligbe said efforts should continue towards having a virile national carrier to address several issues in the local aviation sector.

“The Federal Airports Authority of Nigeria (FAAN), telling airlines to move to other airports (as reported recently) is happening because we don’t have a national carrier. If we do, that will not happen because a national carrier will naturally distribute traffic. The government should maintain the focus on national carrier and concession the airport, but it should not take forever,” Aligbe said.