CIBN, Ecobank collaborate on financial inclusion

The Chartered Institute of Bankers of Nigeria (CIBN), said it plans to collaborate Ecobank Nigeria, in the drive for financial inclusion and capacity building.

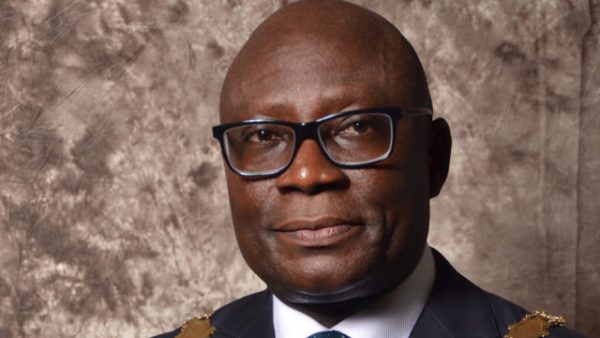

The President and Chairman of Council, CIBN, Uche Olowu, speaking during a CIBN stakeholder’s engagement with Ecobank’s management yesterday, in Lagos, said the Institute will also collaboration with the bank to promote ethics and professionalism in the sector.

Olowu said the bank’s activities in developing the banking sector, aligns with the Institutes’ new leadership strategic areas, which include skills and competency, ethics and professionalism, research and advocacy. He said: “We facilitate registration and enrolment of members of staff for professional banking examinations and other certification programmes. We enable the registration of senior executives of the banks on the Chartered Banker MBA Programme, and there are many things we can do together to move the banking industry forward.”

Olowu commended Ecobank’s strategies to attract the unbanked and under-banked in Nigeria through its various digital offering such as RapidTransfer, Ecobank QR payment option, the EcobankPay, and the Xpress Account amongst others.He maintained that apart from the stress-free transaction processes enjoyed with these digital products, they are fast boosting business and economic activities across the markets, noting that Ecobank’s recent activities across various markets clusters are a major boost to the Central Bank of Nigeria’s (CBN) financial inclusion policy.

In his remark, Managing Director, Ecobank Nigeria, Patrick Akinwuntan, said Ecobank will continue to leverage its digital banking in a sustainable manner to bring banking services to every household in Nigeria. He emphasized that the bank is at the forefront of providing mobile payment solutions in the country.

Akinwuntan, who took the council members through the various Ecobank digital payment solutions and collections, disclosed that the bank has concluded plans to inaugurate 50 EcobankPay zones across Nigeria within the next six months to boost transactions in the various market clusters.

He commended CIBN’s strides in instituting ethics and professionalism in the banking sector, and its effect on the financial industry. He assured of the bank’s continuous support for the Institute and the growth of banking in Nigeria and Africa.