BDCs move to eliminate multiple exchange rates

To arrest continuing fall in the value of the naira against the United States dollar and eliminate multiple exchange rates in the country, the Association of Bureau De Change Operators of Nigeria has introduced an online exchange rate platform and fixed the naira to dollar reference rate at 399.

The intention, according to the association, is to help reduce the gap between the official interbank rate and parallel market rates.

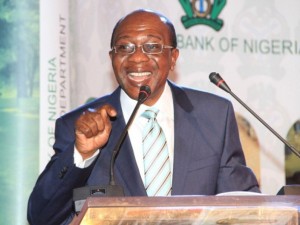

The President, ABCON, Alhaji Aminu Gwadabe, said at a press conference in Lagos that members of the body had agreed to set a weekly reference rate to improve liquidity and help rebuild investors’ confidence in the economy.

“Once liquidity improves, the wide margin between the parallel and official market rates will be bridged,” he said.

He said that ABCON believed that despite the challenges facing the economy, the Central Bank of Nigeria and the BDCs would continue to work together and find sustainable solutions that could help the country wriggle out of the ongoing forex crisis and achieve full economic recovery.

Gwadabe said, “We have continuously assured the CBN and taken appropriate measures to ensure that purchased funds are disbursed to end users and for eligible transactions only.

“We also render weekly returns on purchases from the banks to the Trade and Exchange Department of the CBN. We also ensure strict compliance to the provisions of the anti-money laundering laws and ensure strict observance of appropriate Know-Your-Customer principles in the handling of forex transactions.”

He said the naira’s outlook was “promising” as crude prices had started to rise.

Gwadabe said the body was seeking approval from the central bank to access dollars from exporters, while adding that ABCON had recommended the suspension of some of its members for failing to submit documents on forex purchases from international money transfer agents.

The currency expert said ABCON was setting the N399 to dollar exchange rate to help the CBN to combat unregulated trading.

According to him, the BDCs will post an exchange rate every Monday on their website from January 16 to “highlight positive rate developments in the market.”

He, however, urged the CBN to combat the multiple exchange rate that pervaded the forex markets last year.

“We urge the regulators and the government to harmonise the multiple exchange rates that pervaded the 2016 fiscal year,” Gwadabe added.

According to the ABCON leader, the foreign exchange market in the country is of great concern, because there is a lot of volatility in it.

He recalled that there had been several circulars from the CBN on the need to provide necessary solutions that would make the naira to rebound.

He said, “Liquidity has shrunk because of the withdrawal of foreign investors from the market, most of them have moved out of the country. And one major factor is the drop in crude oil prices in the international market, and the dwindling foreign reserves.

“In Nigeria, we have not been able to build strong buffers, so that when we witness this type of thing, like other countries, we will be protected.

“For instance, the United Arab Emirates has over $400bn in their reserves, and that is a very big buffer for them as it protects their local currency at any given time. Don’t forget that without the buffers, there is no way one can defend the local currency.”

Highlighting the role of the BDCs, Gwadabe said, “The fact is that when you talk of the BDCs, there are parallel market operators and black market operators. The parallel market is the opposite of the official market. So, the BDCs are not parallel market operators. There are over one million parallel market operators in this country and they have been here even before the coming of the CBN. They have been here even before the CBN licensing of the BDCs.