Shell’s oil production in Nigeria hits five-year high

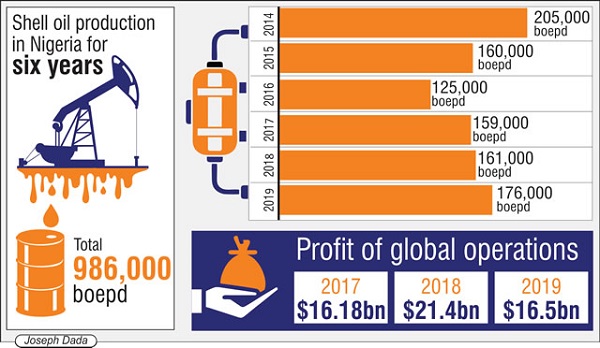

Global oil and gas giant, Royal Dutch Shell, has said its total production in Nigeria increased in 2019 to 176,000 barrels of oil equivalent per day, the highest level in five years.

Global oil and gas giant, Royal Dutch Shell, has said its total production in Nigeria increased in 2019 to 176,000 barrels of oil equivalent per day, the highest level in five years.

Shell, which announced its fourth quarter 2019 results on Thursday, said its profit fell by 23 per cent to $16.5bn last year, hit by sliding oil and gas markets.

The global firm’s profit jumped 36 per cent to $21.4bn in 2018 from $16.18bn in 2017.

Its total production in Nigeria stood at 161,000 boepd in 2018, up from 159,000 boepd in 2017.

The company’s production in the country fell to as low as 125,000 boepd in 2016 amid a resurgence of militant attacks on oil infrastructure in the Niger Delta, compared to 160,000 boepd in 2015 and 205,000 boepd in 2014.

Shell’s liquids production available for sale in Nigeria rose to 65,000 barrels per day in 2019, from 51,000 bpd in 2018 and 47,000 bpd in 2017.

The oil major’s natural gas production available for sale in Nigeria increased to 642 million standard cubic feet per day from 638 million scfpd in 2018. It stood at 647 million scfpd in 2017.

It reported a profit of $2.9bn for the last three months of 2019, down from $5.7bn in the final quarter of 2018.

The group’s exploration and production division reported a loss of $787m, compared with a profit of $1.6bn in the same quarter a year ago, because of lower oil prices, decommissioning costs and write-offs related to its business in Albania.

The results fell below analysts’ expectations, sending Shell shares down almost four per cent to £20.52, their lowest level in two and a half years.

The company blamed weaker oil and gas prices, which drifted down last year due to a well-stocked global market and concerns over global economic growth which dampened demand for fossil fuels.

The Chief Executive Officer, Ben van Beurden, said the company faced “challenging macroeconomic conditions” in its petroleum refining and chemicals business, “as well as lower oil and gas prices” last year.

He, however, vowed to complete the company’s plan to pay back $25bn to shareholders who had accepted shares in lieu of dividends in recent years.

The share buy-back programme was expected to end this year, but the pace will depend on Shell cutting its debt and on other macroeconomic conditions, according to The Guardian.

Shell raised fears of a delay to the programme after warning investors late in 2019 that it would take a $2.3bn hit in the fourth quarter due to a weaker global economy.

Other major oil companies including Chevron, BP, Repsol and Equinor have all written off billions of dollars due to a slump in US shale prices.