Nigeria’s Economy Expands by 2.54% y/y Against All Odds….

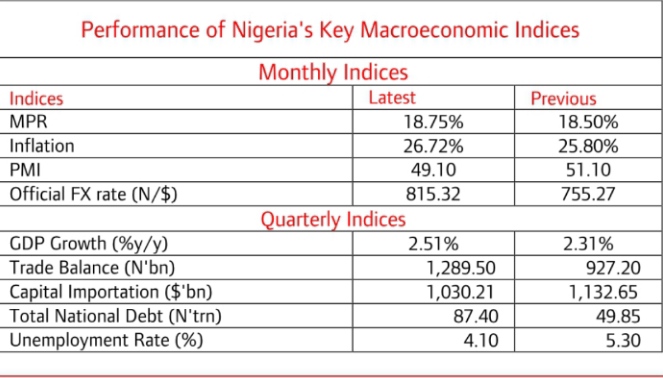

The latest GDP report from Nigeria’s National Bureau of Statistics reveals encouraging trends in the country’s economic performance. The real GDP recorded a positive growth rate of 2.54% year-on-year in the third quarter of 2023, surpassing both the corresponding period in 2022 and the preceding quarter of 2023. This growth, standing at 2.54%, reflects the resilience of Nigeria’s economy, demonstrating its capacity to rebound amidst challenges, including election-related uncertainties and the impact of government reforms. Notably, this marks the strongest economic performance so far in 2023, contributing to a positive narrative amid concerns such as election -related uncertainties and ongoing governmental changes.

Examining the nominal terms, the aggregate GDP for Q3 2023 reached N60.7 trillion, indicating a substantial year-onyear nominal expansion of 16.08%. The Services sector emerged as a key driver, exhibiting an impressive expansion of 3.99% and commanding a significant 52.70% share in the aggregate GDP. This underscores the sector’s dominance and influential role in shaping the overall economic landscape of Nigeria. Further sectoral analysis reveals positive contributions from Agriculture and Industry, with the latter rebounding from a notable contraction in Q3 2022, signaling positive shifts within the industrial landscape and aligning with broader economic stabilization efforts.

Despite the overall positive outlook, challenges persist, particularly in the oil sector, which contributed 5.48% to the total real GDP in Q3 2023. The report indicates a negative year-on-year growth of 0.85%, showcasing a complex scenario for this sector. Nonetheless, the average daily oil production of 1.45 million barrels per day reflects positive strides, attributed to a reduction in pipeline vandalism, curbing oil theft, and the phased implementation of the Petroleum Industry Act. Meanwhile, the non-oil sector demonstrated resilience, growing by 2.75% in real terms in Q3’23, with key drivers including telecommunications, financial institutions, trade, crop production, food, beverage, tobacco, construction, and real estate. Despite minor fluctuations, the non-oil sector’s contribution to real GDP remains substantial, portraying a dynamic and evolving economic landscape in comparison to the same period in 2022.

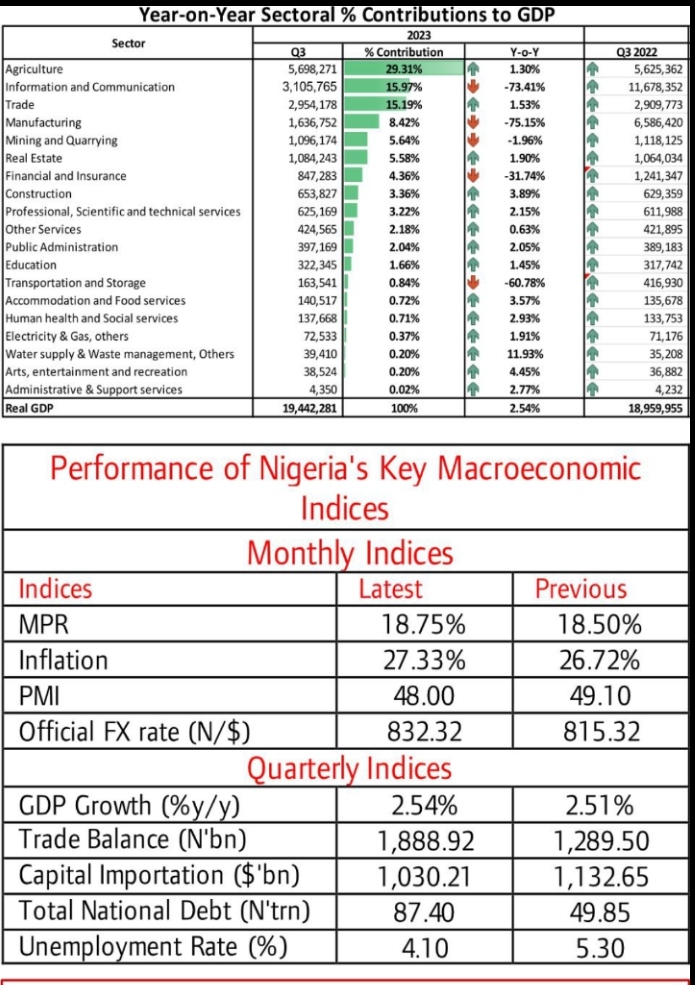

Nigeria’s Inflation Uptrend Peaks at 27.33% in October…….

The National Bureau of Statistics recently released its October 2023 report, revealing a persistent upward trend in Nigeria’s annual inflation rate, which reached 27.33%, marking the tenth consecutive monthly increase. This surge, the highest since August 2005, is attributed to various factors, including elevated import costs, the Naira’s vulnerability, and the federal government’s removal of the fuel subsidy. The escalating transportation costs, driven by the surge in petrol prices since May 2023, along with the adverse effects of climate change on food production and ongoing security challenges, have collectively contributed to the inflationary pressures.

A critical driver of inflation in Nigeria, the food basket, witnessed a significant increase, with the food inflation index rising to 31.52% in October 2023, the highest since August 2005. Persistent security challenges in food-producing regions were the primary cause. Noteworthy year-on-year increases were observed in prices of various food categories, including bread and cereals, oil and fat, potatoes, yams, fish, fruit, meat, vegetables, and dairy products. Despite these challenges, there was a positive development as food inflation reversed its monthly uptrend in October, showing a 1.91% increase, reflecting a 0.54% decrease compared to September 2023, attributed to reduced rates of increase in the average prices of specific food items.

The core inflation index, excluding volatile agricultural produce and energy, recorded a year-on-year increase of 22.58% in October 2023, marking a 5.12% rise compared to the same period in 2022. This index registered notable increases in prices of items such as passenger transport, medical services, housing rentals, and pharmaceutical products. However, the month-on-month reading indicated a core inflation rate of 1.39% in October, reflecting a decline of 0.83% from September 2023. Key contributors to the overall inflationary pressures included a significant 18.33% rise in transportation costs, attributed to fuel price surges, increased spare parts costs, and higher transportation expenses due to deteriorating road conditions. Additionally, housing costs increased by 14.21% in October 2023, driven by heightened building material costs and growing demand for rental accommodation amid population growth.

Ambitious 2024 Budget and the Call for Fiscal Caution….

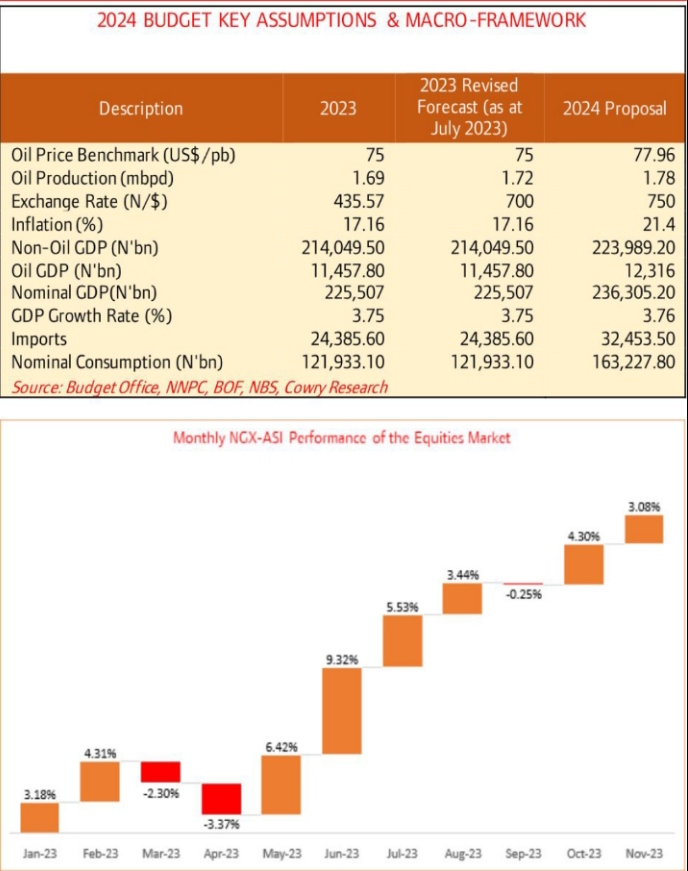

2024 BUDGET KEY ASSUMPTIONS & MACRO-FRAMEWORK Description 2023 2023 Revised Forecast (as at July 2023) 2024 Proposal Oil Price Benchmark (US$/pb) 75 75 77.96 Oil Production (mbpd) 1.69 1.72 1.78 Exchange Rate (N/$) 435.57 700 750 Inflation (%) 17.16 17.16 21.4 Non-Oil GDP (N’bn) 214,049.50 214,049.50 223,989.20 Oil GDP (N’bn) 11,457.80 11,457.80 12,316 Nominal GDP(N’bn) 225,507 225,507 236,305.20 GDP Growth Rate (%) 3.75 3.75 3.76 Imports 24,385.60 24,385.60 32,453.50 Nominal Consumption (N’bn) 121,933.10 121,933.10 163,227.80 Source: Budget Office, NNPC, BOF, NBS, Cowry Research President Bola Tinubu presented Nigeria’s FY-2024 national budget on November 29, 2023, revealing a substantial increase to N27.50 trillion, a 10.8% rise from the preceding year. Titled ‘Budget of Renewed Hope,’ the primary focus revolves around stimulating economic growth, job creation, and infrastructural development. The financial foundation of the budget relies on a strategic blend of oil and non-oil revenues, complemented by planned borrowings to meet fiscal obligations. A brief look into the FY-2024 budget allocates N6.48 trillion to personnel and pension costs, representing 35.4% of projected aggregate revenues. Capital expenditures in 2024 are set at N8.70 trillion, surpassing the 2023 provision. The projected fiscal deficit for 2024 is N9.18 trillion, accounting for 50% of total FGN revenues and 3.88% of the estimated GDP. Revenue projections for 2024 stand at N18.32 trillion, with N7.94 trillion (43.3%) from oil-related sources and N10.39 trillion from non-oil sources. The budget reflects a positive shift towards increased spending on education (8.00% or N2.18 trillion) and infrastructure development (5% or N1.32 trillion), addressing critical areas for economic growth.

A retrospective analysis of the FY-2023 budget, incorporating a recently approved supplementary budget, indicates a robust 79.3% performance in gross oil and gas revenue, amounting to N5.58 trillion as of September 2023. Despite a 20.7% shortfall in net oil and gas revenue, settling at N2.93 trillion, the net non-oil revenue exceeded expectations by N1.62 trillion, with Customs revenue being the sole underperformer at 27%.

Meanwhile, the Federal Government of Nigeria (FGN), as of September 2023, achieved a retained revenue of N8.65 trillion, surpassing the pro-rata target. Notably, oil revenues constituted 84.7%, totaling N1.42 billion, while non-oil tax revenues reached N2.50 trillion, showcasing an impressive 135% performance. Significant accomplishments included Corporate Income Tax (CIT) and Value Added Tax (VAT) collections, surpassing targets significantly at 221.4% and 111%, respectively. However, Customs collections fell short, achieving only 73% of the target. The FY2023 aggregate expenditure, inclusive of the supplementary budget, stood at an estimated N24.82 trillion, with actual spending at N12.7 trillion. Key allocations included N5.79 trillion for debt service, N3.78 trillion for personnel costs, and N1.47 trillion for capital expenditure in Ministries, Departments, and Agencies (MDAs), influenced in part by the introduction of the “Bottom-up Cash Plan” arrangement. The fiscal deficit for FY-2023 was projected at N13.79 trillion, with an actual deficit of N4.05 trillion, primarily financed through domestic borrowing.

Financial Industry Warms Up for Year Ahead, Capitalisation Still Imminent….

In November, the newly appointed Central Bank of Nigeria (CBN) governor, Olayemi Cardoso, unveiled his strategic vision during the 58th annual Chartered Institute of Bankers of Nigeria (CIBN) dinner on November 24. In his address, Cardoso outlined key priorities for his administration over the next five years:

1. Inflation Targeting Mechanism: Cardoso expressed the intention to implement an inflation targeting mechanism to bolster the disinflation strategy. This suggests a commitment to managing inflation rates effectively for economic stability.

2. Liquidity Management Strategies and Cessation of Quasi-Fiscal Interventions: The governor aims to enhance liquidity management strategies while discontinuing quasi-fiscal interventions. This signals a shift towards more prudent and market-oriented financial management.

3. Policy Communication and Embrace of Orthodox Strategies: Improved policy communication and a preference for orthodox strategies are on the agenda. This indicates a commitment to transparent communication and a move towards conventional, widely-accepted economic policies.

4. Recapitalization of the Banking Sector: Cardoso emphasized the need for recapitalizing the banking sector to support the ambitious goal of growing the economy to $1.0 trillion over the next eight years. This underscores the pivotal role of a robust banking sector in achieving economic growth targets.

While acknowledging the ambitious goals set by the new CBN governor, it is noteworthy that achieving these targets hinges on a collaborative and synchronized efforts as well implementation of supportive strategies by both the Federal Government, particularly in terms of trade and fiscal policies, and the Central bank.

Domestic Equities Market: Nigerian Stocks see Higher Pricing, Defies Market Volatility…

In November, the local equities market demonstrated robust bullish momentum, marking a gain of 3.08% month – on-month (m/m). This positive performance, sustained from previous months, defied market volatility, driven by notable buying interest. The benchmark All-Share index experienced a divergent rally, reaching a historic high of 71,566.58 basis points. This milestone was achieved amid a ranging market and increased macroeconomic challenges, including weak economic growth. Despite these headwinds, highly priced stocks and low-cap companies hitting new 52-week highs contributed to the remarkable performance, buoyed further by impressive corporate earnings that fortified investor confidence in the equity space.

The total market capitalization of listed equities increased by 2.66% m/m, reaching N39.05 trillion. Positive investor sentiment led to a repricing of major stocks, resulting in a substantial N1.01 trillion in gains. A noteworthy event in the month was Mercure Industries Plc’s listing of 4 billion shares on the NGX growth board at the beginning of November, elevating the segment’s capitalization by over N11.8 billion.

This move spurred positive buy interest, with investors strategically positioning themselves in fundamentally attractive stocks. Consequently, monthly trading activity saw a bullish trend, with average volume and value traded rising by 44.3% and 31.1% m/m to 486.1 million units and N6.8 billion, respectively.

Sectoral performance in November was predominantly bullish, with the Oil & Gas index leading the gains at 11.85% m/m. This surge was propelled by increases in OANDO, SEPLAT, CONOIL, and GEREGU. Following closely were the Insurance and Banking sectors, which gained by 8.74% and 4.42%, respectively, driven by price rallies in SUNUASSUR, ROYALEX, CONHALLPLC, UNITYBNK, FBNH, ETI, FCMB, and GTCO. On the flip side, the Industrial and Consumer Goods Sectors experienced declines of 1.93% and 0.63% m/m due to selloffs in THOMASWY, BETAGLASS, ELLAHLAKES, DANGSUGAR, NAHCO, and HONYFLOUR.

The leading gainers and losers in November reflect the intricate interplay of market dynamics as investors strategically realign their portfolio holdings ahead of the season-end rally. Advancers such as DEAPCAP (136%), NSLTECH (124%), NNFM (93%), MULTIVERSE (86.88%), and OMATEK (57.78%) underscored the positive market sentiment. Conversely, THOMASWY (43%), ELLAHLAKES (18%), STANBIC (16%), TIP (15%), and ETRANZACT (13%) were notable losers during the month, reflecting the nuanced nature of investor decisions in response to evolving market conditions.

Foreign Exchange Market: Naira Trades Mix Across FX Segments….

In November 2023, the global oil market witnessed a sharp reversal from the previo us rally, with ICE Brent futures falling to a four-month low of around $80 per barrel. The decline was driven by concerns about softening global oil demand amid ongoing OPEC+ supply cuts. Initial support for oil prices from escalating Middle East conflicts faded as geopolitical risks diminished. Concurrently, the surge in U.S. oil production, reaching pre-pandemic levels at 12 million barrels per day, played a crucial role in offsetting global supply constraints and contributing to market volatility.

In the foreign exchange market, the Naira demonstrated a divergent performance against the USD In the NAFEM segment, experiencing a 2.09% m/m depreciation to reach N832.32 against the dollar at the close of November. Concurrently, the parallel market witnessed a contrasting trend, with the Naira appreciating by 1.19% m/m, settling at N1,162 per dollar. Furthermore, trading activity within the NAFEM exhibited a notable strengthening, recording a 27.9% increase to establish a monthly average turnover of $140.6 million.

Foreign Exchange Market: Naira Trades Mix Across FX Segments….

In November, the liquidity situation in the system improved significantly, rebounding to N2.7 billion from the previous month’s negative balance of N557.7 billion. This positive shift was primarily driven by net Standing Lending Facility (SLF) inflows amounting to N2.1 trillion, which effectively countered liquidity outflows of N1.0 trillion resulting from net issuances of Open Market Operations (OMO) and Nigerian Treasury Bills (NT-Bills). Consequently, the Overnight Policy Rate (OPR) and the Overnight (OVN) rates experienced declines of 74 basis points and 92 basis points month-on-month, settling at 14.8% and 15.5%, respectively.

Money Market: Yields See No Respite in November Amid System Liquidity Crunch….

In November, the liquidity situation in the system improved significantly, rebounding to N2.7 billion from the previous month’s negative balance of N557.7 billion. This positive shift was primarily driven by net Standing Lending Facility (SLF) inflows amounting to N2.1 trillion, which effectively countered liquidity outflows of N1.0 trillion resulting from net issuances of Open Market Operations (OMO) and Nigerian Treasury Bills (NT-Bills). Consequently, the Overnight Policy Rate (OPR) and the Overnight (OVN) rates experienced declines of 74 basis points and 92 basis points month-on-month, settling at 14.8% and 15.5%, respectively.

Elsewhere, the CBN held an Open Market Operations (OMO) auction amounting to N250 billion across four offerings (91-day: N50 billion, 182-day: N50 billion, 267-day: N50 billion, and 364-day: N100 billion). Due to weak demand (0.5x bid-offer ratio) at the auction, the CBN allotted only N77.2 billion across all tenors. Meanwhile, in the secondary T-bills market, there was buy interest in the short and the long end of the curve which pushed the average yield to experience an 87-basis points month-on-month dip to 10.5%.

Bonds Market: Sell Pressure Drive Average Yield Upward; Eurobonds Sustain Bullish trend……

In the secondary bond market, prevailing sell pressure persisted, exerting downward pressure on overall performance as the average yield increased by 32 basis points month-on-month to reach 15.5%. This rise in yield was evident across all tenors, with medium-term and long-term instruments experiencing selloffs, leading to a 59 basis points and 71 basis points month-on-month increase, respectively. Conversely, short-term instruments witnessed some buy interest, resulting in a 37 basis points decrease in yields to settle at 13.5%.

At the November 2023 FGN Bond auction, the Debt Management Office (DMO) of Nigeria issued N360 billion worth of Federal Government of Nigeria (FGN) papers to investors but successfully raised a higher amount, reaching N434.5 billion. The total subscriptions for these government securities amounted to N445.3 billion, resulting in a bid-to-cover ratio of 1.0x. Although slightly lower than the 1.1x ratio observed in the previous auction held in October ’23, the auction still demonstrated investor interest in government debt instruments. The benchmarks offered in this auction were the Apr ’29, Jun ’33, Jun ’38, and Jun ’53. The new stop rates for these securities were set at 16.00% (compared to the previous rate of 14.90%) for Apr ’29, 17.00% (versus 15.75%) for Jun ’33, 17.50% (compared to 15.80%) for Jun ’38, and 18.00% (as opposed to 16.60%) for Jun ’53. These adjusted rates reflect an upward movement, indicating a potential increase in the cost of government borrowing.

Continuing its positive momentum from the previous month, the Eurobond market showcased a strong performance in November. The market’s positive trajectory was fueled by robust buying a ctivity and a resurgence of investor confidence across all maturity periods. The combined impact of these factors contributed to a notable reduction in the average yield, declining by 83 basis points month -on-month. By the end of November, the average yield stood at 10.57%, marking a significant decrease from the 11.40% recorded in the preceding month. This positive trend suggests a favourable environment for Eurobond investors during the reported period.