JET-A1, others may push flight above N100,000 – Domestic airlines

Domestic airlines under the aegis of the Airline Operators of Nigeria have said that rising operational costs occasioned by aviation fuel price hikes, foreign exchange shortage, among others may push the base economy flight ticket to N100,000.

The spokesperson for local airlines/Chairman, United Airlines, Professor Obiora Okonkwo, made the disclosure during an exclusive interview with media source on Wednesday in Abuja.

Aside from the lingering aviation price hike crisis, the airline chief said local operators were being compelled to source foreign exchange from the parallel market at high rates due to a lack of adequate supply from the Central bank of Nigeria via the commercial banks.

Consequently, he said an increase in the base economy flight ticket to at least N100,000 might be inevitable for all domestic airline operators if the current situation persists.

Okonkwo said, “Obviously, it is inevitable. I can tell you that all the airline operators, in the last three months, have been losing money, a huge amount of money. There is too much stress on the operational fronts for them to break even. Even if the aviation fuel is made available, there must be a review to reflect the minimal operational cost. We are offering patriotic services to the nation and understand the essential part of it. We are part of this economic development process in Nigeria but it is coming at a very huge sacrifice.”

He added, “Nothing less than N100,000, between N100,000 and N120,000 base price, even with Jet A1 fuel at N400 – N500. That is what it is.”

In this regard, he added that meetings with the CBN ad yet to yield any positive result in the provision of adequate forex.

He further stressed the need for the aviation industry to be seen as an essential service that should have special consideration in financial matters.

Okonkwo clarified that the operators have no joy in increasing fares but it has become necessary for them to avoid shutting down and running out of business.

He added, “In the industry, it is expected that you will gain some here and lose some here but the biggest challenge indigenous operators are having is that the cost of everything is high. You source money from the commercial bank rates. You source money from the black market. No moratorium for your loans and the banks and AMCON are quick to jump on you.”

Corroborating this view, the Chief Operating Officer, Ibom Air, Mr. George Uriesi, said local airlines had reached a point in their operational cost whereby “something has to give in.”

Uriesi said, “Something has to give in. It’s either the prices of fuel that come down or the prices of airfares go up from where they are. So far, the airlines have tried very much to work within the airfares as they are. All sides of the divide are aware that the airlines have done the best that they can do.

“I don’t know what tomorrow holds but at some point, if the airline doesn’t survive, it goes down, to the detriment of everybody-the people who work for the airline, the people who fly on the airline, the country’s economy, everything goes down. So, airlines are just trying to be stable and patriotic. That’s where we are.

Uriesi, a former managing director of the Federal Airports Authority of Nigeria, said it was difficult to tell how long the local carriers would be able to continue with the high operational cost.

“It’s very hard to say, we are watching the business every day, we’re watching a number of parameters. We’re watching the load factor, we’re watching the yield per passenger, we are watching the cost of operating at the price we’re paying every day which keeps going up every few days. So, the truth from this is that, when it becomes clear that you will not be able to sustain yourself, then you’ll have to adjust some of your indices, always taking into consideration the ability of the passenger to pay because you can’t just raise prices just because fuel has gone up. If you issue what they can’t pay, then you will not carry anybody, you would have committed suicide.”

However, industry experts said the unfolding development would not augur well for the local airline industry, saying it could make its outlook bleaker.

The Chief Executive Officer, Centurion Aviation Safety and Consult, Group Captain John Ojikutu, (retd), said, “This is not a good sign for the domestic airline industry. We should ask ourselves why the four refineries have not been working for the past 20 years. If you have refineries and crude oil, and you are refining, there should be no reason for the type of increase in aviation fuel price we’re having.

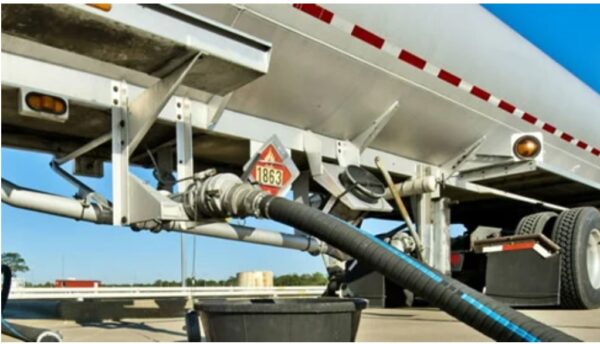

‘Even when this fuel gets back to this country, we transport them by fuel tankers when in other countries they transfer them through pipelines.”

According to a former Managing Director of Associated Airlines, Mr Alex Nwuba, foresee a reduction in passenger traffic if airfares become too high.

He said, “We didn’t die when flights couldn’t operate during the COVID-19, people adapted so people will adapt. They may just have to forfeit some trips that are not important and focus on trips that are important. They could also decide to choose alternative methods of travel when the fares are too high.”

A former Director of Operations, IRS Airlines, Kenneth Wemambu, said, “Airlines have been losing money. A business person, if the cost of operation increases by over 200 per cent, you will need to avoid running the business. This is why the possibility of an airfare hike can’t be ruled out.