Why we intervened in forex market –CBN

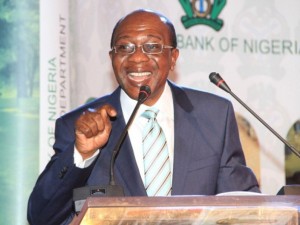

The Central Bank of Nigeria on Thursday said that its current intervention in the foreign exchange market was purely to ease the pressure on the naira and had nothing to do with succumbing to blackmail from some quarters.

The Acting Director, Corporate Communications Department, CBN, Mr. Isaac Okoroafor, stated this while reacting to some trending posts in the social media to the effect that the current appreciation of the naira was as a result of the alarm raised about the illegal sale of forex at ridiculous rates to some people.

A Lagos-based businessman and former governorship candidate, Babatunde Gbadamosi, had claimed that the CBN was engaged in racketeering in the allocation of forex, which he alleged, had led to disparity in the allocation of foreign exchange to cronies of the present administration.

Gbadamosi, who had accused the CBN of selling dollars to some people for as low as N3, was later arrested by the Department of State Services and has been in detention for over five days.

But reacting to the development, Okoroafor said that the CBN did not sell dollars directly to individuals and that the figures being cited by Gbadamosi were as a result of formatting errors during the filing of forex returns by Deposit Money Banks to the CBN.

He said the banks involved had been queried and responses obtained from them, adding that the appreciation of the naira was in no way connected to the allegations of Gbadamosi.

Okoroafor stated, “I want to state categorically that there is no relationship whatsoever between the allegations by the so called person that dollar was being sold at 61 kobo and the current appreciation of the naira.

“What led to the appreciation of the naira is that the CBN has done its intelligence work on the market and we came to the realisation that much of what was driving the demand at the Bureau De Change and parallel market was speculation.

“We reasoned that since there is a lot of pressure on the two segments from people seeking to buy foreign currencies for Business Travel Allowance, tuition and medicals that if we successfully address that, the pressure will come down.

“Also, before now, the level of our reserves was not enough to make us comfortable enough to really do the kind of intervention that is required. We decided to do so now because we are a bit more comfortable with our level of reserves.”

The apex bank spokesperson noted that since the new forex policy, the CBN had intervened with over $500m in the market, which had led to naira gaining strength.

He added, “Let me also state as prove that when we placed $500m in the market, only $370m was taken. That tells you that the real demand is $370m. When we placed $230m in the market, only $221m was taken.

“Anybody who has gone foul of the law, and the security agencies have caught up with him, should go and face his or her case and stop causing confusion among participants in the market.”