ULC raises alarm over Nigeria’s rising debts

Urges Senate to reject loan request

Urges Senate to reject loan request

Worried by the Federal Government’s plans to borrow about $2.8 billion from foreign capital, and another $87 million from same resources to refinance already existing debts, the United Labour Congress (ULC) of Nigeria, is alarmed that Nigeria’s debt profile has continued to increase and burgeoning at an alarming proportion.

The Congress noted that the Federal Government is in such a hurry to plunge the country back into the death trap that it had already worked assiduously to escape from the past administration.

While calling on the Senate to reject government’s request, the union insisted that further borrowing to finance this year’s budget will ruin Nigeria’s future.

It expressed concern that in just three years, Nigeria’s debt profile had grown to nearly $30 billion, and still increasing with the recent amount being demanded for approval by the Federal Government.

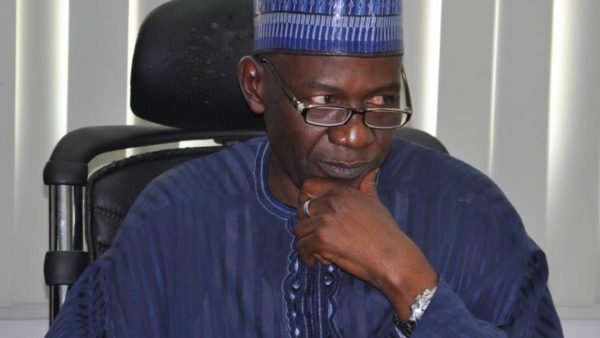

ULC, in a statement by its President, Joe Ajaero, noted that the impact of continuous borrowing creates a spiral negative effect, thereby decreasing the capacity of the economy to fund developmental projects as the debts pile up.

It further explained that debts reduce space for fiscal manoeuvrability in the nation, especially when returns on the debts become negative specifically to its refinancing portfolio, increasing burden on the revenue, and gradually push the economy to resort to more borrowing to fund interest repayments.

Ajaero, who recalled when the country suffered the last debt crisis, said: “Our foreign creditors had to place stringent conditionality on our economic policies, thus undermining our freedom as a sovereign and an independent nation.

“Rushing back into a trap that we escaped from is akin to a pig that goes back to the mud right after taking a bath. It is as if we have not learnt from our past mistakes, and are fully bent albeit in a haste to go right back into the same debacle that we gave so much to escape.

“We therefore seriously condemn the plan to borrow that huge sum to finance part of the 2018 budget. It is unacceptable to us as it does not make economic and common sense at this time. We remember that this year’s budget is predicated on crude oil benchmark of about $55/barrel but the current international price is around the $88/b mark. This is clearly about $30/b in excess that accrues to our Excess Crude Oil Account. Fortunately, since this year, prices have remained consistently well above this benchmark.”