Tinubu Orders Naira Crude Sale, Marketers Project Price Crash

The approval given by President Bola Tinubu for the sale of crude oil to the Dangote Petroleum Refinery in naira is going to force the prices of domestically refined petroleum products to crash, oil marketers, refiners, and experts stated on Monday.

Operators in the downstream oil sector commended the move by the President, stating that it would boost the outputs of domestic refineries, shore up the country’s foreign exchange reserves, and strengthen the naira.

They also hailed the media for always putting the matter on the front burner, stressing that Nigerian refineries should not continue to struggle to get the United States dollar to procure a commodity that is produced in-country.

On Monday, Tinubu directed the Nigerian National Petroleum Company Limited to sell crude to the Dangote refinery and other upcoming refineries in naira.

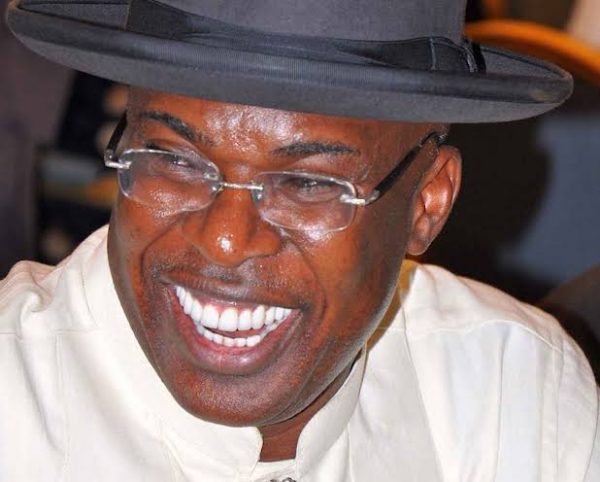

The Special Adviser to the President on Information and Publicity, Bayo Onanuga, made this known in a post via his official X handle.

Onanuga said the Federal Executive Council adopted the move on Monday to ensure the stability of the pump price of refined fuel and the dollar-naira exchange rate.

Dangote refinery has been embroiled in a crude oil supply crisis with the International Oil Companies operating in Nigeria. Later, it had some confrontations with the country’s midstream/downstream regulator.

The 650,000 barrels per day refinery got crude oil earlier this year from NNPC and a few IOCs but raised an alarm later that IOCs were not willing to supply crude to the plant, as it had to switch to the massive importation of crude oil.

Dangote refinery currently requires about 15 cargoes of crude oil at about $13.5bn yearly. NNPC has committed to supply four. The latest order by the President would make the supply of this product to Dangote and other domestic refineries to be done in naira and not dollars.

Onanuga also revealed that the Federal Executive Council approved that the 450,000 barrels meant for domestic consumption be offered in naira to Nigerian refineries, using the Dangote refinery as a pilot.

In his statement on X, titled, “President Tinubu offers a lifeline to Dangote refinery, NNPC to sell crude to it in naira, the presidential media aide said, “To ensure the stability of the pump price of refined fuel and the dollar-naira exchange rate, the Federal Executive Council today adopted a proposal by President Tinubu to sell crude to Dangote refinery and other upcoming refineries in naira.

“Dangote refinery at the moment requires 15 cargoes of crude at $13.5bn yearly. NNPC has committed to supply four. But the FEC has approved that the 450,000 barrels meant for domestic consumption be offered in naira to Nigerian refineries, using the Dangote refinery as a pilot. The exchange rate will be fixed for the duration of this transaction.

“Afreximbank and other settlement banks in Nigeria will facilitate the trade between Dangote and NNPC Limited. The game-changing intervention will eliminate the need for international letters of credit. It will also save the country billions of dollars used in importing refined fuel.”

Also speaking on the development, the President’s Special Adviser on Revenue, Mr Zacch Adedeji, who also serves as Chairman of the Federal Inland Revenue Service, said Monday’s move mitigates Nigeria’s heavy reliance on foreign exchange for crude oil imports, accounting for roughly 30 to 40 per cent of its forex expenditure.

The revenue chief said that by denominating crude oil transactions in naira, the government expects to significantly lighten its forex burden, with estimated annual savings of $7.3bn. It is also expected to reduce monthly forex expenditure on petroleum products to $50m from approximately $660m.

“Monthly, we spend roughly $660m in these exercises, and if you analyse that, that will give us $7.92bn savings annually,” he stated.

The presidential aide further explained, “With this approval today; this has reduced by a minimum of 90 per cent because what we have today will mean transaction is now done in our local currency, not only with Dangote refinery, but to all local refineries for all our local consumptions and this will stabilise the pump price.”

He said the new move will ease economic predictability as forex fluctuations are expected to reduce.

Adedeji enumerated the benefits of the new regime, including “The reduction in foreign exchange pressure, as the existing process that we have today utilises $660m per month, a total of $7.92bn annually.

“With the new approval that we have, this will reduce to a maximum of $50m per month which is annualised to be only $600m. This is a total reduction of 94 per cent and saving us $7.32bn.

“This will also reduce finance costs, which today stand at $79m when you consider the opening letter of credit between those local refineries and what happens.”

On the implementation, the FIRS chief said, “As a pilot, the council has approved that a settlement bank, which in this instance is Afrieximbank, would be the lead arranger between NNPC and Dangote refinery.

“One of the major directives of Mr President and the council is that Afriexim leads the advisory work of structuring and arranging this initiative with the Associated Trade Finance Facility, in collaboration with the Central Bank of Nigeria, the Nigerian National Petroleum Company Limited and the Federal Ministry of Finance and other critical agencies.”

Operators speak

Oil marketers and operators of modular refineries lauded the initiative, as they further outlined the gains it would accrue to Nigeria.

The National Public Relations Officer of the Independent Petroleum Marketers Association of Nigeria, Chief Ukadike Chinedu, said, “We want to use this opportunity to thank the President for listening to the voice of the masses and marketers because we have repeatedly stated that the panacea to this frequent scarcity of petrol is for us to localise the sale of crude oil in Nigeria, especially in Nigerian naira.

“The President has listened to this and the cry of labour because he has expressly approved the N70,000 minimum wage. These approvals are very significant to the Nigerian economy, especially the sale of crude to Dangote in naira. It will strengthen and the value will rise in the international market. This is one of the best developments in Nigeria’s oil sector.”

On his part, the Publicity Secretary of the Crude Oil Refiners Association of Nigeria, Eche Idoko, said the supply of crude to local refineries in naira would bring down the cost of petrol and strengthen the naira against the dollar.

Idoko, who commended Tinubu for listening to the voice of indigenous refiners, however, pleaded that an executive order should be issued on the new directive.

He also sought a meeting with the economic team to work out a rate that would favour the Nigerian market.

“The sheer fact that the crude will be sold in naira will give the naira a lot of leverage against the dollar, and by implication, the naira will appreciate against the dollar. Automatically when there are fewer naira chasing the dollar, it will affect the price. It means the cost of refining will drop and this will affect the pump price.

“We also need to sit with the price monitoring team, that is, the economic team of the government. Good thing, by Tuesday, we will meet with the Nigerian Midstream and Downstream Petroleum Regulatory Authority team on fees and rates. These also affect the pricing of petroleum products. The economic team needs to sit with refiners so we can have a robust programme that will give a price advantage to local consumers within Nigeria.

“Yes, we will see a rebound in the pricing of fuel once the President’s order is implemented. Mind you, the pronouncement alone is not enough. It must be with a force of law, either by executive order or by incorporating it into a new guideline so that the crude producers will be bound to sell to us in naira,” Idoko stated.

A Professor of Energy at the University of Lagos, Dayo Ayoade, remarked that it was not surprising that the Federal Government had finally agreed to give crude oil to Dangote and other refineries after the firms had spent a lot to invest in the sector.

However, Ayoade sought to know if the crude meant for local consumption had not been used to acquire loans.

“It is good news if the government knows that the crude has not been forward-sold by the last administration. I hope the Federal Government is able to supply Dangote 650,000 barrels when it comes to full capacity. BUA will come on board with a 200,000 barrels per day capacity; NNPC is there with its refineries and they will also need 400,000 barrels. So, we are looking at over a million barrels for domestic consumption.

“This means the government will have to be serious about crude oil theft and we need to ramp up to about 2.5 million bpd,” the don said.

Dangote’s complaints

Dangote refinery and other domestic refiners have been complaining about the difficulties associated with accessing crude oil for their plants. Last week, the management of Dangote Group insisted that the IOCs were still frustrating crude supply to the 650,000-capacity refinery.

In a statement, the group alleged that the IOCs insisted on selling crude oil to its refinery through their foreign agents, saying the local price of crude will continue to increase because the trading arms offer cargoes at $2 to $4 per barrel, above NUPRC official price.

The group also alleged that the foreign oil producers seem to be prioritising Asian countries in selling the crude they produce in Nigeria.

The Vice President of Oil & Gas, Dangote Industries Limited, Mr DVG Edwin, said, “If the Domestic Crude Supply Obligation guidelines are diligently implemented, this will ensure that we deal directly with the companies producing the crude oil in Nigeria as stipulated by the Petroleum Industry Act.”

Edwin insisted that IOCs operating in Nigeria have consistently frustrated the company’s requests for locally-produced crude as feedstock for its refining process.

He highlighted that when cargoes are offered to the oil company by the trading arms, it is sometimes at a $2 to $4 (per barrel) premium above the official price set by the Nigerian Upstream Petroleum Regulatory Commission.

“As an example, we paid $96.23 per barrel for a cargo of Bonga crude grade in April (excluding transport). The price consisted of a $90.15 dated Brent price plus a $5.08 NNPC premium plus a $1 trader premium. In the same month, we were able to buy WTI at a dated Brent price of $90.15 + $0.93 trader premium including transport. When NNPC subsequently lowered its premium based on market feedback that it was too high, some traders then started asking us for a premium of up to $4m over and above the NSP for a cargo of Bonny Light.

“Data on platforms like Platts and Argus shows that the price offered to us is way higher than the market prices tracked by these platforms. We recently had to escalate this to NUPRC,” Edwin said, urging the commission to take a second look at the issue of pricing.