Senate summons CBN, MTN, banks over $13.9bn transfer probe

The Senate on Thursday summoned the Central Bank of Nigeria, MTN Nigeria, the Financial Reporting Council of Nigeria, three commercial banks and some businessmen over alleged violation of the Foreign Exchange (Monitoring and Miscellaneous) Act.

The upper chamber of the National Assembly had instituted a probe into what it called the illegal transfer of $13.9bn by MTN from Nigeria to other countries between 2006 and 2016.

The Senate Committee on Banking, Insurance and Other Financial Institutions was mandated to carry out the probe by conducting an investigative hearing on the “unscrupulous violation of the Foreign Exchange (Monitoring and Miscellaneous) Act.”

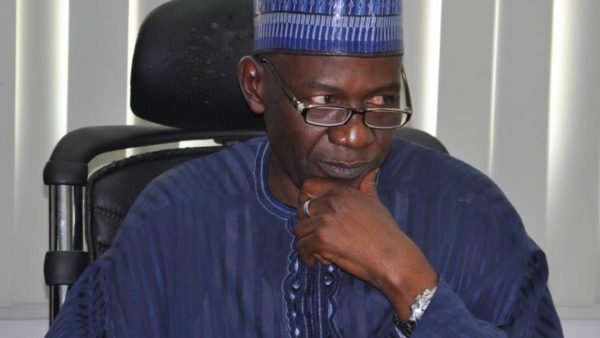

The summons was contained in the “Notice of Appearance” issued by the Chairman of the committee, Senator Rafiu Ibrahim, to the affected organisations and individuals, and obtained by our correspondent.

The notice read in part, “Pursuant to Senate Resolution S/Res/017/02/16 of 27th of September, 2016 on the above subject matter, the organisations and individuals listed below are invited to appear before the Senate Committee on Banking, Insurance and other Financial Institutions on Thursday, 20th of October, 2016.

“The organisations and individuals who have not submitted the documents requested for in our earlier letter of 29th of September, 2016 are advised to do so on or before Tuesday, 18th of October, 2016.

“Mobile Telecommunications Network, Central Bank of Nigeria, Financial Reporting Council of Nigeria, Dr. Pascal Dozie, Colonel Sani Bello, Dr. Okechukwu Enelamah, Ahmed Dasuki, Gbenga Oyebode, Babatunde Folawiyo and Victor Odili.”

Also invited are Stanbic IBTC, Standard Chartered Bank, Citibank and Diamond Bank

The Senate began the probe on September 27, 2016, when a member of the upper chamber representing Kogi-West Senatorial District, Senator Dino Melaye, alleged that MTN illegally repatriated the sum out of the country through its bankers.

The lawmaker alleged that MTN transferred through Stanbic IBTC the sum of $4.87bn; Standard Chartered Bank, $5.72bn; Citi Bank, $2.98bn; and Diamond Bank, $0.35bn.

Melaye, who recalled that MTN, which is headquartered in South Africa, was incorporated in Nigeria as a private Limited Liability Company on November 8, 2000 and obtained its operating licence with $284.9m on February 6, 2001, alleged that the company did not request the Certificate of Capital Importation for the transaction.

He said, “The Senate observes that MTN did not request for the Certificate of Capital Importation from its bankers, Standard Chartered Bank, within the regulatory period of 24 hours of the inflow. The Senate observes also that the CBN was not notified of this inflow by Standard Chartered Bank within 48 hours of receipt and conversion of the proceeds to naira as required by regulations.

“It further observes that the sum of $117,683,987bn was also brought in by MTN between 2001 and 2003 in three different tranches. It is concerned that since inception, MTN had sought the collaboration of influential and unpatriotic Nigerians to assist them in looting our external reserves.”

The Nigerians, Melaye added, included a serving minister, who MTN allegedly used in moving $13.92bn out of the country, a sum that is over 50 per cent of the country’s external reserves, to floated and incorporated offshore Special Purpose Vehicles in the Cayman Island, Mauritius and British Virgin Island.

Melaye added, “The Senate was alarmed that the Minister of Industry, Trade and Investment, Dr. Okechukwu Enelamah, owner of CELTELCOM Investment Limited with address at No.608, St. James Denis Street, Port Lewis, Mauritius, purportedly claimed to invest in MTN on the 7th of February, 2008, got a Certificate of Capital Importation and filled the Form ‘A’ on the same date) and closed his investment in Nigeria after receiving dollar payment for repatriation to New York same day.

“It is also aware that these offshore entities were offered shareholders loan and their repayment to the extent of repatriation of proceeds of dividends back to MTN International South Africa through the entities and operators of the SPVs brought on board as directors of MTN Communications.

“The Senate observes that after five years of operation in Nigeria, the management of MTN Nigeria Limited suddenly realised that they needed the Certificate of Capital Importation to enable them to commence repatriation of funds realised from their businesses.

“It observes also that MTN directed their bankers, i.e. Standard Chartered Bank, Citi Bank and Diamond Bank, to issue Certificate of Capital Importation for inflows that came in five to seven years ago, which their bankers obliged without the relevant approval from the CBN.”

The lawmaker stated that what MTN’s bankers did was in strict violation of Section 15 of the Foreign Exchange (Monitoring and Miscellaneous) Act, 1995.