International Customs Day 2022

How Ready Is Nigeria Customs Service For Digital Transformation?

Achieving A Data Culture: The WCO Prescription

Digitalization: NCS Is Evolving With Fast Pace – Malanta

Customs Automation Process Has Some Loopholes – Nwabunike

Fully Digitalized Customs Operations

Will End Corrupt Practices

Customs Should Prioritize Advanced Ruling Document – Mukaila

How Ready Is Nigeria Customs Service For Digital Transformation?

As the world marked the International Customs Day(ICD) on January 26th,2022, raising awareness on the veritable means of enhancing supply chains and economic competitiveness, the Customs procedures and practices in Nigeria are characterized by two conflicting ideological framework. They are: Trade Facilitation and Revenue Generation. This, expectedly, has birthed three schools of thought that have remained unyielding in their respective ideological conviction. But while the battle rages, the economic space suffers the brunt.

The International Customs Day (ICD) is celebrated on 26 January to commemorate the inaugural session of the World Customs Organization WCO), which was held on this day in 1953. The day also raises awareness about the importance of customs authorities and their role in the smooth movement of goods across borders.

Every year, the WCO observes International Customs Day by organizing events to raise awareness about the importance of customs authorities and their contribution to global trade. Several seminars, conferences and workshops take place on this day on various aspects related to the movement of goods across international borders.

Customs authorities are extremely important in facilitating legitimate trade and helping governments levy tariffs, and earn revenue, from the movement of goods across international borders. These authorities also coordinate to prevent illegal trade in products such as body parts of endangered species like rhino horns, drugs and other prohibited substances.

History:

The WCO was formed in 1952 as the Customs Co-operation Council (CCC). The main function of this independent governmental body was to boost the efficiency and effectiveness of customs administrations, according to its official website.

The inaugural session of the council was held on 26 January, 1953, with 17 member countries participating in the event. Since then, the organization has expanded to 183 members.

Significance:

The WCO represents 183 customs administrations which collectively process about 98 per cent of world trade, according to the organization. The WCO is the only global body which represents the international customs community.

Headquartered in Brussels, Belgium, it is also responsible for maintaining international standards and cooperation between different customs administrations. The WCO also helps in border control issues and in securing fair revenue collections

However, one of the core challenges in the Nigeria’s peculiar operating system remains absence of enhanced data culture and a sustainable data ecosystem. It was therefore a welcome development to note that the World Customs Organization(WCO) dedicated the 2022 ICD to enhancing customs procedures and practices through digital transformation as expressed in the theme:”Scaling up Customs Digital Transformation by Embracing a Data Culture and Building a Data Ecosystem”.

In the midst of the prevailing ideological dichotomy, the question remains: How ready is the Nigeria Customs Service(NCS) for digital transformation? Does the significance of the ICD have any impact on Nigeria’s Customs authority and operations?

Under the bipolar Nigeria Customs ideological operating space, many freight forwarders and organized private sector operators believe that the yearly revenue target handed down to NCS by the Federal Government negates the principle and spirit of trade facilitation. So, while some stakeholders see Nigeria Customs’ primary function as revenue generation, others hold on to the belief that it is principally trade facilitation, which has always been the preoccupation of the WCO. NCS has been given a target of N4.1trillion in 2022 fiscal year, a task stakeholders believe is a misnomer that drives them to adopt the introduction of multiple alerts and too many cargo delivery as well as high way encumbrances, aimed at generating revenue to hit the target.

To the NCS, however, trade facilitation is a tool for enhanced revenue generation, presupposing that they are interwoven.

At the media briefing of December 20th, 2021, the Deputy National Public Relations Officer(PRO) of NCS, Deputy Comptroller Timi Bomodi defined trade facilitation as “The simplification, harmonization and modernization cum automation of import and export processes, aimed at reducing trade costs and increasing revenue. It also helps the development of local industries, improves economic prosperity, and enables foreign direct investment.”

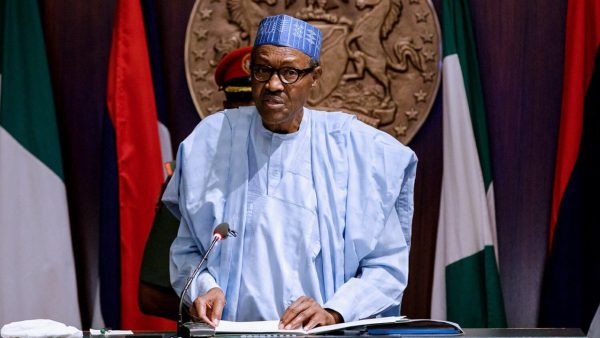

Similarly, reacting to the growing concerns of the organized private sector, at the media parley in Abuja, last week, to mark the 2022 ICD, the Comptroller General of Customs(CGC), Col. Hammed Ali (rtd)dismissed fears that the NCS has abandoned its traditional role as a trade facilitator for revenue generation. He quipped: “I want to seize this opportunity to clear the impression in certain quarters that we have abandoned our role as a trade facilitator. I want to put it on record that the role expected of us as trade facilitator, revenue generation and protection of interest of Nigerians are interwoven. None is more important than the other.”

The Minister of Finance, Dr. Zainab Ahmed, recently joined the debate when she was reported to have said that the revenue generation function of the NCS would be assigned to another agency of the Federal Government, Federal Inland Revenue Service(FIRS) to enable Customs focus on its trade facilitation function.

In the heart of this flame of debate is the exigency of digital or e-customs operations to reduce human interference in cargo delivery, a point that underscores the significance of this year’s ICD theme.

However, with the tons of complaints from shippers against the Customs processes and procedures in cargo delivery in the Nigerian ports, it is pretty difficult to believe that NCS has an automated operating system that guarantees seamless and fast cargo delivery.

According to Bomodi, “NCS has integrated and automated over 90 percent of its activities. Members of the public have continued to avail themselves of copious information on both its web based and mobile applications. The e-Customs project which is certain to take off next year(2022) will provide end-to-end automation aimed at eliminating physical contact and the potential for subjective judgment based on unethical considerations”.

Perhaps, in fulfillment of their plans for the e-Customs regime in 2022, the CGC has said the Service had placed orders for 135 Scanners to be deployed at airports, seaports and border stations across the country. But are these developments enough proof that the NCS is ready for digital transformation? Are the scanners sufficient to serve the locations they are meant for? Read our interviews with operators and senior customs officers.

-

Achieving A Data Culture: The WCO Prescription

-

The Secretary General of the World Customs Organization (WCO), Dr. Kunio Mikuriya, announced that this year’s International Customs Day (ICD), which is marked annually on 26 January, will be celebrated under the slogan: “Scaling up Customs Digital Transformation by Embracing a Data Culture and Building a Data Ecosystem”. The global Customs community is invited to implement the theme throughout this year and beyond, and reflect on how best to operate in a fully digital environment and create an operating model that captures and exploits data from across the trade ecosystem.

Over the years, digital technology has evolved rapidly and Customs can now tap into data from other government agencies, commercially available databases, and open-source information platforms such as digitized global public records and multilingual news sources. The extent to which data can be used effectively depends on various factors surrounding data ethics, including privacy, commercial secrecy and legal issues regarding the use of data by Customs and Tax administrations, and the importance assigned to innovation in public administrations.

To build data ecosystems, or consolidate existing ones, the following enabling actions may be considered: i) establishing formal data governance to ensure the relevance, accuracy and timeliness of data; ii) making use of the standards developed by the WCO and other institutions regarding data format and data exchange; iii) providing appropriate management of data to ensure that the right people have access to the right data, and that data protection regulations are respected; and, iv) adopting progressive approaches, such as data analytics, to collect and successfully exploit data to drive decision-making.

A robust data culture empowers people to ask questions, challenge ideas and rely on detailed insights, not just intuition or instinct, to make decisions. In order to nurture a data-driven culture, administrations need to enhance the data-literacy of their staff – in other words, their ability to interpret and analyze data accurately. Customs administrations should integrate data science into their curriculums for newly recruited officers and participate in the development of distance learning courses to familiarize Customs officers with the collection and analysis of data in order to forge a data-driven culture. Staff also need to understand the bigger picture, namely the impact of Customs on the effective protection of society, trade facilitation and fair revenue collection.

On the other hand, Customs administrations are invited to consider leveraging data in their relationships with other actors along the supply chain, as well as making data available to the public and academia as a means of enhancing transparency, stimulating the production of knowledge and enabling dialogue with civil society. Sharing data analysis with other government agencies increases the role and visibility of Customs in policy-making and in obtaining necessary resources, including donor funding. Disseminating Customs data and information in society is part of governments’ response to the general demand for open governance.

To support Customs administrations, the WCO Secretariat has placed data-related topics on the agenda of several committees and working groups, organized awareness-raising seminars, developed e-learning modules, drafted a Capacity Building Framework for Data Analytics which was adopted by the WCO Council in December 2020, issued practical publications and published articles in the WCO News Magazine. Moreover, a community of experts has been established, under the name of BACUDA (BAnd of CUstoms Data Analysts), which brings together Customs and data scientists with the objective of developing data analytics methodologies. The Secretariat will continue to investigate ways to collect and share data on Customs administrations with a view to enhancing the way it delivers capacity building, and will continue to undertake data-driven assessments and work with international experts to respond to assistance requests.

More measures will be presented in the WCO Data Strategy that the WCO Secretariat is currently working on. The ambition will be to make data a vernacular language among Customs administrations and between the WCO Secretariat and WCO Members. The road ahead is not an easy one, there will inevitably be challenges along the way, but as we have learned during the COVID-19 pandemic, the Customs community is united, stronger and more resilient in the face of adversity.

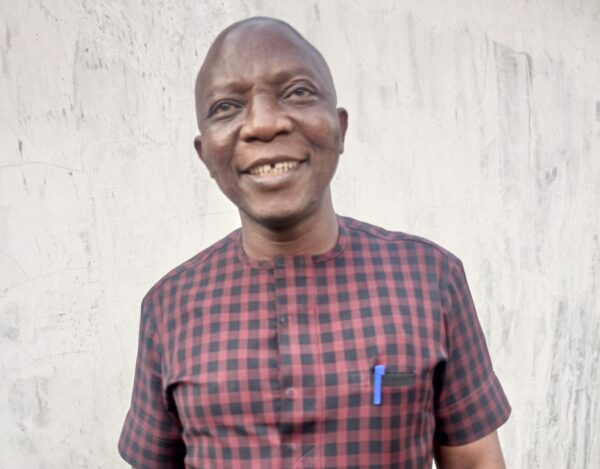

Digitalization: NCS Is Evolving With Fast Pace – Malanta

Malanta By Kenneth Jukpor

Comptroller Yusuf Malanta is the Customs Area Controller at Nigeria’s premier port, Apapa. He shares his thoughts on the International Customs Day celebration which was held on Wednesday, even as highlights some of the exploits of Nigeria Customs Service (NCS) on automation. Malanta also harps on certain digital platforms introduced by Customs that could serve as a National Single Window if gainfully utilized. Enjoy it:

What is the significance of World Customs Day to you?

This is a global celebration for Customs Service and it’s a time for Customs to look at its operating environment holistically in a bid to deliberate on a theme. The theme for this year is “Scaling up Customs Digital Transformation by Embracing a Data Culture and Building a Data Ecosystem” and data refers to information.

In the 21st century, all over the world and across all sectors information is very significant. For Customs, we are talking about information about the items, information about the systems and information of freight agents. This information is used for data mapping that leads to the creation of a data ecosystem. For example, if a person imports a certain type of consignment, the system would store the records for decades. As soon as the person’s name is entered on the system, all the history of such a person can be assessed. This explains the digital transformation of Customs processes.

Over the years NCS has been making progress via digitalization from the ASYCUDA, ASYCUDA++ to NICIS I and NICIS II. However, we can still see papers on your table which means someone still has to write a letter or bring certain documents to your office before getting his cargo out of the ports. How soon would NCS attain a complete paperless system?

Digitalization is a process. We have come a long way from the era of ASYCUDA 2.7 way back in 1997 to ASYCUDA ++ which transformed into e-payment. Earlier ASYCUDA 2.0 brought in the transmission of electronic ship manifests. In declaration, there has been an upgrade from the time when customs did the data capturing to the Direct Traders Import (DTI) and later we introduced DTI on an individual basis where everyone has a login password to access the system to make payment before crossing into the Customs zone. So, the process has been simplified unlike the past where we had Long Rooms.

Today, the Customs process has been divided into two; Traders zone and Customs zone. In the entire trader zone there is nothing like hard copy papers because you get your Pre-Arrival Assessment Report (PAAR) as a soft copy, sit at the comfort of your office or home to access the portal and make payment. An examination officer will be selected electronically. The decision to know whether the consignment will go on blue lane, red lane, green lane or fast track are issues that are done electronically in a paperless system.

Despite the electronic process Customs is doing, you see papers and documents in my office because we have about 10% which includes applications like amendment by correcting a manifest. The stakeholder isn’t privy to making these submissions online. When the stakeholder has to make an application to the Area Controller because there was an error in the original transmission and he wants to modify this error, NCS hasn’t reached the level where such amendments can be done electronically. It is when we attain that level of automation that NCS would have attained complete digitalization of Customs processes and that’s the goal of e-Customs.

With e-Customs, everyone will be centralized with the use of computers. However, it is important to note that even in the most-digitized banking systems they still have paper documentation today. The major conglomerates in the oil and gas sector such as Chevron still have some degree of paper transactions because there must be a certain percentage of the work that requires such documentation.

Shipping companies are one of the stakeholders that lament continuously about this paper system as they spend billions printing hard copy documents such as ship manifests given to Nigeria Customs Service (NCS). Would e-Customs also solve this problem?

This problem has already been solved because we have given the shipping companies the leverage to submit the manifests online from the source. The issue is that they want to manipulate that manifests, so instead of transmitting the documents from the source they transmit it from the last port of call. If shipping companies transmit these documents from the source which is the ideal process, there would be no need for the corrections which constitutes a large percentage of the documents on my table.

Customs shouldn’t be receiving letters of amendment to correct the consignee’s document from the shipping lines. This is a process where the consignee buys something abroad and receives an invoice that is given to a shipper who processes the bill of lading and sends the manifests to Customs. What’s the need for making an amendment if the original manifest from the port of origin is sent to Customs? Shipping companies have to be sincere with themselves.

The hard copy is the captain’s manifest which has to correspond with the system manifest to make sure that checks and control is in place. In most cases we find a lot of problems when reconciling these documents. How can they claim to be spending billions of naira on manifests sent to Customs? If a ship has 1000 containers, it wouldn’t have 1000 pages of manifests because one bill of lading can have 100 containers. The hard copy manifest could be less than 100 pages and they also give these hard copy manifests to ship captains. Why aren’t they giving digital manifests to captains?

Let’s also note that a manifest is the complete inventory of all cargoes onboard a vessel and Customs need to be aware because of the security risks as well as duty purposes. I don’t see how shipping companies would spend billions for these manifests even though they also send these manifests to the Nigerian Ports Authority (NPA). There was a time when shipping companies had to send eight copies of these manifests to several units of Customs such as Enforcement, CIU, Gate, Long Room, CAC, Valuation and others. At that time, they didn’t do the manipulations we see today. Now, they have the liberty to transmit these manifests electronically but they have started withdrawing some bill of lading after transmitting it. They change the structure of the bill of lading and come up with new ones or sometimes we receive double transmission of manifests. This is a major issue we are facing and it is a glaring problem. Shipping companies should learn to be very transparent.

Could these reasons have informed the decision of the Central Bank of Nigeria (CBN) to prioritize e-invoicing, because that is already generating issues?

E-invoicing is very important because it means that people wouldn’t doctor their invoice from the port of call. The supplier or manufacturer would transmit the invoice straight based on the value of the Form M. This way there wouldn’t be a case of manipulation where the original invoice of the importer is different from the one given to Customs.

I think e-invoicing is part of the digital transformation that has come to stay around the world. Nigerian traders have to change and adjust to the emerging digital trends and circumstances.

The Comptroller-General of Customs said the Service is going to have 135 scanners which show the level of preparedness for automation by NCS. However, there are concerns that the number is too much. Does this connote that Apapa port could have as much as five or six scanners?

There are numerous border stations in Nigeria. You shouldn’t just look at the seaports because the scanners will also be at airports and land borders. If you’re travelling to Dubai or England, you must pass through a scanner and whatever you have to declare would also be scanned. You can argue that you didn’t see a Customs officer to frisk you but the Customs officer has done his job electronically.

When you look at it from this perspective, you will realize that 135 scanners wouldn’t be enough. All international airports functional and non-functional ones require scanners. We also have to be futuristic in our planning, so it’s not when we have the ports functional that we start sourcing for scanners.

These are high definition scanners (HDMI). They will have capability of storing the images and be able to handle over 20 containers in an hour.

Stakeholders have raised concerns that some consignments come in groupage. Would this be an impediment for the scanners such that there would have to be physical examination after scanning such containers?

There is no problem with groupage. Scanners will show the content of cargoes and identify the various items based on the colour and image analysis. The analysts are professionals, they have been taught how to differentiate the images and tell the items.

WCO is talking about digital transformation and NCS has been on this path for some years with ASYCUDA, ASYCUDA++ and the present NICIS II, but there concerns that while NCS is evolving and training its personnel, less emphasis is on training freight agents who are Customs main partners. What’s your take on this?

At every stage of the upgrade and innovation of NCS, we have trained freight agents. We call them and put them through. Nevertheless, I think this issue is a matter of interest and mindset. Every freight agent who has the interest would learn and the one who doesn’t want to change his or her mindset would be left behind. SGD is selected electronically. Freight agents don’t have to carry it to the examiner but some don’t want to change.

We have trained them and we continue to train. I have also observed that most of these Customs licensed companies keep employing and changing their members of staff. When they change their personnel after a few months there is a vacuum for the new person to learn afresh. In a few months, the new person may decide to start his personal company or join another company and there is a vacuum again. That’s why the process is such that most of them have their passwords.

NCS is moving with high speed when it comes to digitalization. Customs is the first to embrace e-transactions and e-payment. Before the federal government came up with the Treasury Single Account (TSA), we have been transmitting our funds directly into the federal account.

We have a digital system and we are carrying stakeholders along because over 52 stakeholders can log into the Customs digital system. It’s the responsibility of these agencies or stakeholders to perform their tasks from the log-in structure on the platform. NAFDAC, SON and others can access the Customs platform and do their work.

Given this platform, why is there still the clamour for a national single window?

Since 2014, NCS has had a trade portal which has been displayed to all stakeholders. This trade portal provides information for anything ranging from HS code to other issues. It’s a platform for all stakeholders. So, what exactly is a Single Window? If everyone could access the trade portal, participate and do his or her business via the trade portal, what’s the need for a different single window because we have it?

This trade portal is recognized by the World Customs Organization (WCO) and World Trade Organization (WTO).

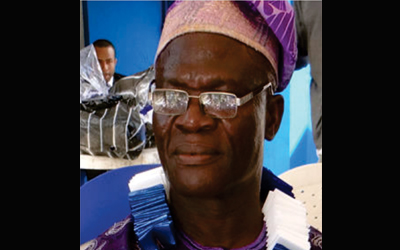

Customs Automation Process Has Some Loopholes – Nwabunike

Nwabunike Hon. Tony Iju Nwabunike is the President of the Association of Nigeria Licensed Customs Agents (ANLCA). In this exclusive interview with MMS Plus he speaks elaborately on the activities of Nigeria Customs Service (NCS) as the World Customs Organization (WCO) marked International Customs Day on Wednesday, January 26th, 2022.

Nwabunike also makes some suggestions that could ease the bottlenecks on freight agents and their importers facilitate trade, whilst enhancing the Customs revenue.

Excerpts:

As the world marks International Customs Day, what are your thoughts for Nigeria Customs Service (NCS)?

Customs, all over the world, have helped to stabilize the economies of nations and actually played a key role in ensuring security at ports and border posts. In Nigeria, as we celebrate the World Customs Day, I would like to speak on the Customs practice in the country and what should be expected from Customs in 2022.

Given what WCO is about and the fact that the 2022 theme is Scaling up Customs Digital Transformation by Embracing a Data Culture and Building a Data Ecosystem; I want to see NCS operate on a level where they embrace the use of Information Communication Technology (ICT) and more digital operations. My expectation is that they evolve further and attain a paperless and more scientific approach to their work.

The WCO theme is centered on modernization. I agree that many laudable changes are happening. Almost three decades ago when some of us entered the maritime industry, customs duty was paid in cash. That era had what we called the Long Room which today has been replaced by Customs Processing Centre. Officers and few privileged agents were trained on basic computer operations under the auspices of United Nations Conference on Trade and Development (UNCTAD)

UNCTAD chose Benin Republic as venue for the training and senior customs officers were sponsored to Cotonou just to learn how to operate computers.

Automated System for Customs Data (ASYCUDA) was the breakthrough stage for us as agents in terms of customs modernization. There were stages of migration from ASYCUDA to ASYCUDA+ and later ASYCUDA++ in the early 2000. The glitches or sever failures experienced in our transactions sometimes, these days, didn’t start now. It was an intermittent feature then.

The evolving and improving state of customs ICT architecture has led to the service using tools of artificial intelligence with capacity to monitor transactions, do profiling, risk assessment, carry out examination (using scanners for image analysis) and more.

Although NCS has progressed greatly, it is still far from where it ought to be. There are gaps to be covered if we embrace attitudinal change and maximize available technologies.

Let me give an example of a yet to be covered gap. In a modernized customs system, infractions such as concealments, smuggling necessitating seizures and arrests can be effected right inside the ports. You don’t need FOU and strike force to either stop, reexamine or chase released cargoes about.

Modernization provides single window for ease of access to information and data by all Government agencies, it enhances economic and security advantages for the country. It is targeted at efficiency and risk reduction. We have not been able to use it to cover all the gaps.

NCS should have their examination of cargoes wholly done by scanners and relieve themselves from the burden of physical examination. NCS should be attained with other WCO member nations to combat trade bottlenecks and facilitate trade instead of the emphasis on revenue generation as they are in Nigeria.

The federal government also has to release Customs from this burden of revenue generation at all times because what it means is that people actually are to enforce import guidelines and procedures, but they find themselves in a very tight situation because of the revenue targets.

When the government says it expects Customs to realize a particular target and the volume of trade isn’t coming as expected, this means that Customs would begin to do double-taxation in a bid to meet their targets. This is the perception of Customs and it’s further enhanced by the revenue targets from the government.

As a member of WCO, the goal for the NCS should be to attain global best standards. As such, they shouldn’t be seen on federal and state roads intercepting cargoes already cleared at the ports. They should be able to finalize their operations in the areas of schedule. There is no need to be on the port access roads or other roads to check what they have done initially.

I have engaged some Comptroller-Generals of Customs over the years and they always insist that the goal is to checkmate their officers, especially those involved in the releasing of cargoes. To address this, I think it’s high time we all prioritize doing the right things. So, there shouldn’t be a need to have Federal Operations Unit (FOU) or Strike force review what the releasing officers have done.

These are issues I want the federal government to look into because the perception of Nigeria Customs Service outside the country and internally, isn’t a good one. The leadership of Customs should equally be concerned about these issues because NCS shouldn’t be seen as doing all these activities just to increase revenue earnings.

One of the recommendations from the WCO is that Customs make available the data they have to the public in order to show transparency, encourage the academia debate and analyze the data for economic growth. How strategic is this practice for NCS?

I do agree that Customs shouldn’t just have this data and keep it to themselves. It is important to share this data with sister agencies and other relevant stakeholders. Recall that the Service was accused by the National Assembly that their remittance wasn’t in line with what they actually put online. These are areas of conflict that we want to streamline.

Having some of this information in the public makes the Service more transparent and encourages a better perception of the good Customs has done and still does. Putting this data in the public domain also simplifies the work of the Service as people appreciate how genuine and transparent they are. It’s definitely a better idea.

WCO emphasizes digital transformation in Customs operations and the need to develop a Data Culture, how significant is it to have freight agents trained to be on the same digital wavelength with Customs in Nigeria?

The major bottlenecks with regards to trade facilitation at the ports result from the disparity or discord between Customs and their licensed agents. These are Customs licensed agents that do business with Customs but they aren’t working in synergy in terms of digital transformation. While Customs has moved up to NICIS II at the moment, so many Customs licensed agents aren’t up-to-date as they are still struggling with ASCUDA ++. Customs have gone past ASCUDA several years ago but their crucial partners weren’t carried along.

I recall that training Customs brokers was more visible some 15 years ago. At that time, there were frequent training across the nation evenly distributed among the six geopolitical zones. This was the norm at that time as Customs had utmost regard for training those that they licensed to work with them. The relationship between Customs personnel and the Customs broker was very nice. Today, that interaction isn’t there and both parties don’t enjoy any deep relationship.

For Customs to facilitate trade and do things rightly in the port sector and border posts, they need to work in tandem with Customs brokers. If they train Customs brokers on their requirements and processes, there will be less people visiting the ports for one problem or another. There will also be less movement of people as the interaction would be online, yet very efficient. People will be better placed to do their jobs professionally and meet global best standards.

NCS has been given a N4.1trillion revenue target for 2022 by the federal government. What implication would this have on freight forwarding activities?

We read about N4.1trillion 2022 revenue target for Nigeria Customs Service in the media. Giving these seemingly outrageous target will undermine the productivity of the overall economy. This high target will place the NCS under pressure of high revenue collection and undermine the trade facilitation role the service should render.

Pursuing bigger revenue and failing to strengthen trade result in greater losses for the country as investments are either threatened, reduced or made nonexistent. The totality of customs efforts deployed into revenue pursuit reduces the service productivity in many ways.

Fully Digitalized Customs Operations

Will End Corrupt PracticesI want to celebrate Customs for the strategic role they play in sustaining the nation’s economy, even as I congratulate them on the occasion of the International Customs Day. The Customs management improved tremendously under the administration of late Abdullahi Dikko. However, most of the efforts introduced by Dikko didn’t enjoy rapid development under the current administration of Col. Hammed Ali (Rtd). This is because efforts to minimize human contact were jettisoned and the consequence which is corruption is seriously affecting Customs.

The current Customs management should seriously scrutinize the service in a bid to curb this unpleasant trend of corruption. The approach should be bottom-up because the emphasis has been on the up-bottom approach over the years. Most of the senior officers are well-trained, distinguished and knowledgeable. They are not willing to compromise themselves to aid or perpetuate sharp practices, but we can’t give the same report about the junior officers.

One can project that in the next few years, the nation is going to have a very terrible Customs Service. This is because most of the top-notch officers who are disciplined are set to retire. Although the NCS management is doing its best to restore sanity and groom the younger officers rightly, there appears to be a gap in terms of knowledge and discipline between the senior Customs officers and the junior ones.

There is also a need for NCS to deepen its relationship with stakeholders to stem this ugly trend of corruption and sharp practices. Senior Customs officers should also be concerned about the workforce they are leaving behind and create time to mentor and groom their successors. Area Controllers, Deputy Controllers and Assistant Controllers are doing their best, but they can’t be everywhere because the junior officers down the chain are responsible for most of the sharp practices in Nigeria.

Another way to address the menace of corruption is to fully digitalize all aspects of Customs operations, so that there wouldn’t be human contact.

While I thank the Comptroller General of Customs, Ali and his management team for their efforts in NCS, I want to remind them that Customs isn’t just about revenue collection. The integrity of the Service, customer satisfaction, service delivery are other key issues that should be reviewed. I understand that NCS is under serious pressure from the federal government to generate revenue, but they should look inwards to address the high level of corruption that is thriving from bottom-up in the service.

Association of Nigeria Licensed Customs Agents (ANLCA)

Zonal Leader, Western Zone

Sir John Offorbike (Dan Kastina)

Customs Should Prioritize Advanced Ruling Document – Mukaila

Alhaji Babatunde Mukaila is the National Secretary of ANLCA. He shares his comments on World Customs Day with emphasis on Nigeria Customs Service.

Excerpts:My expectation for NCS as the world celebrates Customs is the attainment of seamless port operations because Customs have a key role. I want the sector to utilize operations that are based on global best practices.The era where Customs officers use their intuition of discretion to regulate trade should be stopped. The trade we are in is governed by global conventions. Nigeria is a party to these conventions and they have already been domesticated in the country. So, no one should have the power or use his discretion to decide the processes. It should be a well-documented, open and transparent process.The best thing that can happen to Nigeria Customs Service (NCS) has already started and that’s the introduction of scanners and e-transactions.Globally, nobody wants to have human contact and I want Nigerian Customs to buy into that since they are part of the World Trade Organization (WTO). Authorized Economic Operator is the latest trend all around the world. Having profiled several companies for decades, NCS should able to come up with over 10 companies that they could give such opportunities so they can take their cargoes out and conclude their documentations afterwards. Big multinationals in Nigeria should be able to enjoy such leverage in cargo evacuation. They shouldn’t be subjected to the same protocol that Customs give to occasional importers.NCS should be making use of international trade tools as designed by the WCO to advance their practice and the collection of duties.NCS N4.1trillion revenue targetI have nothing against it because if Customs do what they need to do, they can target N6trillion. If NCS delivers N2trillion in Nigeria, I can boldly state that they must have kept N3trillion for themselves.Nevertheless, the concern of freight forwarders and importers is that NCS is able to tell us what is the cost of duties and the appropriate duties. There is something called Advanced Ruling and this a known trade tool. I don’t have to be groping in the dark because I want to import a generator of 100KVA, I should have an Advanced Ruling document from Customs.The Advanced Ruling document should be binding between Customs and the trading public. This document should tell the HS Code, the Customs duty rate and other necessary details that one needs to know. This document should also guide importers and freight agents in their planning for imports.A situation where a Customs officer says a HS Code is wrong or the duty is incorrect, but Customs consistently refuse to adopt Advanced Ruling is wrong. In some instances, when you ask why they say the duty or HS Code is wrong, the officer asks you to leave his office. They know that you’re on demurrage and you have to pay storage or rent charges, therefore, you’ll be forced to do their bidding. In other words, you will be blackmailed into giving them bribes.If Customs truly decide to automate its processes and utilize Advanced Ruling system, they can target N6trillion and realize it.I don’t need to meet any Deputy Controller or the OC gate for a consignment that has been duly scanned by a Customs officer in the port. The image and result of scanning is already stored. Everyone should be able to access this scanned image that should be uploaded by Customs online.CEMA AmendmentNCS has to hook up to what is going on globally. At the last hearing, the Minister of Finance who happens to be the supervisory Minister wasn’t aware of most of the changes in the new bill. The Permanent Secretary said they got the document 48hours before the hearing. A lot of fundamental changes were going to be smuggled in without the knowledge of the Finance Ministry.They were going to change the Chairmanship of the Customs board to a retired DCG, instead of the Minister of Finance. They also want serving ACGs and DCGs to be in the board. So, it’s going to be Customs kill and Customs bury. They need to carry people along in these changes.