How To Unlock Oil Assets Via NUPRC’s Innovation In Bidding Process

Before now, high signature bonus was the determinant factor in Nigeria’s oil bidding process and this had hindered early development of oil and gas fields.

Signature bonus is the single, non-recoverable lump sum payment made upfront by oil companies to the government for the rights to develop an oil block commercially after successfully winning the asset.

To encourage investors, the Nigerian Upstream Petroleum Regulatory Commission (NUPRC)has now removed all the entry barriers that impeded the development of oil and gas assets, including the slashing of the signature bonus to only $10 million for deepwater assets and $7 million for shallow water and onshore assets.

The commission’s targets include: To grow oil and gas production, enhance Nigerian Content Development, attract Foreign Direct Investment (FDI), contribute to long-term global energy sufficiency, expand opportunities for gas utilisation, and create employment opportunities and also add value to government and investors.

Reduction of signature bonuses also became necessary in view of the dwindling capital for oil and gas projects caused by the rising Capital Expenditure (CAPEX) being channeled by investors into funding alternative renewables under the global energy transition.

NUPRC’s innovation aligns with trends in other countries, where the governments have drastically reduced signature bonuses to attract investors and financiers.

For instance, in the Middle East and North Africa, signature bonus currently stands at about $10 million while Thailand and Indonesia have about $3 million and N1.5 million, respectively.

With NUPRC’s action, Nigeria’s oil and gas operating environment is now in alignment with the rest of the world.

Commenting on the development, the Executive Chairman, African Energy Chamber (AEC), NJ Ayuk, said: “Nigeria has established a robust framework that is set to attract foreign exploration companies with modernised fiscals that are competitive for deepwater exploration. We the AEC believe the most lucrative balancing point between creating a welcoming environment for international companies and achieving Nigeria’s own national goals is important.

“Key to this bidding round will be the role of independents and indigenous players when it comes to exploration. The bidding round also paves the way for gas monetisation that will bring amazing benefits to Nigeria and also international markets.”

On his part, the Executive Director, Emmanuel Egbogah Foundation for Petroleum, Prof. Wumi Iledare, said: “A high signature bonus is regressive. It does make a petroleum province with a high signature bonus less attractive.”

Similarly, the National President of the Oil and Gas Service Providers Association of Nigeria (OGSPAN), Mazi Colman Obasi, said: “Investors need a conducive environment to put their money. Once the right environment exists, foreign capital will begin to flow in.”

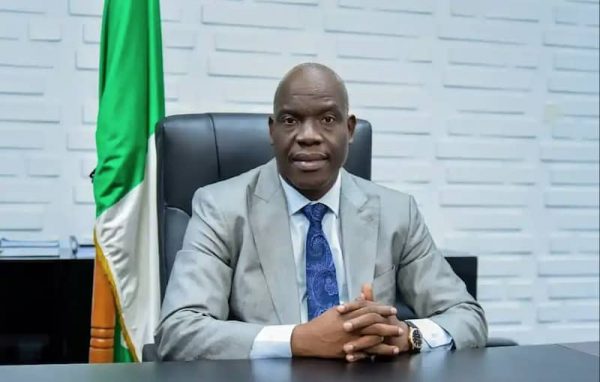

Speaking at the recent pre-bidding conference in Lagos, the Chief Executive Officer of NUPRC, M. Gbenga Komolafe, said: “A review of Welligence Energy Analytics reports on licensing rounds across the globe, including Brazil, Guyana, Angola, Middle East, North Africa, South East Asia, revealed that the era of huge front-loaded signature bonuses is over.

“Accordingly, Nigeria under President Bola Tinubu, as the Minister of Petroleum Resources has proactively and intuitively vacated the barrier to entry for investment in exploration blocks being offered, in both the 2022 deep offshore bid round and the 2024 licensing round, in line with international best practices.”

He said: “President Bola Ahmed Tinubu and Minister of Petroleum Resources, have embarked on a transformative agenda that aligns with the most stringent global standards and commitments. The recent Presidential Executive Orders issued in March this year, aimed at improving the efficiency and attractiveness of Nigeria’s oil and gas sector, were generously targeted to incentivize oil and gas development, introduced measures to balance the implementation of Nigerian Oil and Gas Industry Content Development Act, 2010 to ensure that oil and gas development is not hindered by local content bottlenecks. The Executive Orders also include directives on the reduction of contracting costs and timelines to enhance the global competitiveness of our oil and gas industry and achieve a higher rate of return on oil and gas investments.

“Nigeria is endowed with abundance of Crude Oil and Condensate Reserves and of Natural Gas Reserves representing above 30 per cent and 33 per cent, respectively of the entire Oil and Gas reserves in Africa aside from an abundant mix of other renewable energy resources. In a bid to exploit and optimize these abundant Hydrocarbon resources, Section 7(t) of the Petroleum Industry Act (PIA) empowers the NUPRC, the Industry Regulator to conduct bid rounds for the award of PPLs and PMLs under the Act and applicable Regulations.

“It is on this premise that the Federal Government of Nigeria through the NUPRC recently announced the commencement of the 2024 Licensing Round both in-country and outside the shores of the nation. It would be recalled that we commenced the announcement at the maiden edition of the NEITI Dialogue Session, 2024, where the bid processes were thoroughly interrogated by civil society and the media,” he explained.

According to Komolafe, the commission aims to project and attract robust local and foreign investors who will be participating in the bid exercise.

He also said: “The NUPRC on behalf of the Federal Republic of Nigeria is committed to conducting the licensing round in a fair, competitive and transparent manner and ensuring a level playing field for both indigenous and international investors. Our approach is underpinned by the robust legal framework of the Petroleum Industry Act 2021(PIA), which ensures compliance with best practices to boost investors’ confidence.”

Speaking on the assets being put on offer, Komolafe said: “Each block has been chosen for its potential to bolster our national reserves and stimulate economic vitality.” He reminded bidders that the deadline to register/submit Pre-Qualifications documents is June 25, 2024.

“Interestingly, the Commission, in partnership with its multi-client partners, has acquired more geological data resulting in the identification of more prospective blocks. The newly identified blocks will be added to the pool of blocks originally scheduled for the bid exercise, and their details will be made available on the bid round portal. In addition to these blocks, the seven deep offshore blocks from the 2022 Mini-Bid Round Exercise which covers an area of approximately 6,700 kilometres in water depths of 1,150m to 3,100metres shall also be concluded along with this Licensing round. This Day.