External Reserves Hit Five-year High of $46bn, Inch Up to $50bn

• NDIC to investigate banks over 38.5% rise in industry fraud

Following the success of the $2.5 billion Eurobond issue by the federal government last month, coupled with higher oil production and prices, Nigeria’s external reserves hit a five-year high of $46 billion on Friday, representing an increase of 18 per cent or $7 billion over the country’s reserves figure of $38.912 billion as of January 2, 2018.

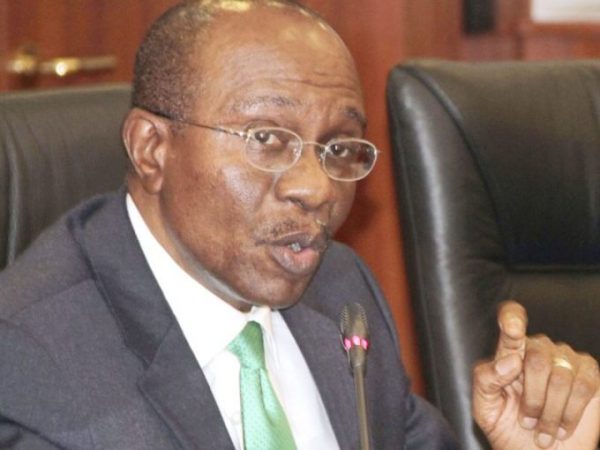

It has also significantly surpassed the $40 billion target for 2018 announced by the Central Bank of Nigeria (CBN) Governor, Mr. Godwin Emefiele, last November, and is expected to inch up to $50 billion in the next few months.

Report by THISDAY also showed that the last time the reserves neared $46 billion was on February 6, 2013.

The federal government last month had raised $2.5 billion through the sale of Eurobonds under its Global Medium Term Notes Programme. The dual notes comprised a $1.25 billion 12-year series and a $1.25 billion 20-year series.

The federal government said proceeds from the Eurobond issue would be used for refinancing maturing domestic debt.

Confirming the latest reserves figures, CBN spokesman, Isaac Okorafor, in a statement yesterday, said the accretion of the country’s reserves was a result of the central bank’s continuous effort at vigorously discouraging unnecessary imports and reducing the nation’s import bill, inflows from oil and non-oil exports, as well as the huge inflows through the investors’ and exporters’ window of the foreign exchange market, which, he said, had attracted over $33 billion since April 2017, when it was created.

According to him, the CBN’s interventions in the forex window also helped to moderate the pressure on the forex reserves by sustaining liquidity in the market and boosting production and trade.

Okorafor also noted that the CBN policy restricting access to forex from Nigeria’s foreign exchange market to importers of some 41 items had made a huge impact on the status of Nigeria’s reserves and boosted the supply of local substitutes for imported goods, created jobs at home, and enhanced the incomes of farmers and local manufacturers.

Meanwhile, the Nigeria Deposit Insurance Corporation (NDIC) has said it will investigate some banks for inadequate rendition of returns to the corporation on instances of fraud, forgeries, and cases involving their employees who were either dismissed or had their appointments terminated on the grounds of fraudulent activities.

The NDIC said it made the decision in the light of the recent report from its off-site supervision of deposit money banks (DMBs) in the country, which revealed that the number of fraud cases attributed to internal abuse by staff of banks increased from 231 in 2016 to 320 in 2017, representing an increase by 38.53 per cent.

Also, it showed that the amount involved in the fraud documented increased also by 38 per cent or by N3.33 billion, from the N8.68 billion reported in 2016 to N12.01 billion in 2017.

Section 35 and 36 of the NDIC Act requires all DMBs to submit monthly information/returns on fraud and forgeries to the corporation.

Although the NDIC report signed by its Head, Communications and Public Affairs, Mohammed Kudu Ibrahim, did not disclose the names of the affected lenders, the report relied on 286 responses received from 26 banks during the period.

The 286 responses received from banks in 2017 cited 26,182 cases of fraud and forgeries, 56.30 per cent higher compared with the 16,751 cases reported in 2016.

However, the expected/actual losses slightly decreased by N24.42 million or 1.03 per cent, from N2.39 billion in 2016 to N2.37 billion in 2017.

Also, internet/online-banking and ATM/card-related fraud-types reported constituted 24,266 or 92.68 per cent of all the reported cases as they made up N1.51 billion or 63.66 per cent of losses in the industry in 2017.

The report also documented other miscellaneous crimes such as fraudulent transfers/withdrawals, cash suppression, unauthorised credits, fraudulent conversion of cheques, diversion of customer deposits, diversion of bank charges, and presentation of forged or stolen-cheques, among others.

In all, the 22 licensed commercial banks and four merchant banks rendered 286 returns on dismissed/terminated staff as a result of fraud and forgeries during the year under review.

Of the 26,182 fraud cases reported by the 26 licensed banks, 320 cases were attributable to internal collaboration by bank staff, leading to the sack or the termination of appointments or dismissal of the same number of employees in 2017.

The losses arising from the reported cases decreased from N760 million in 2016 to N682 million or about 11.43 per cent in 2017.

The corporation attributed this improvement to “additional internal control measures adopted by the banks in the wake of the proactive corrective measures taken to ensure their compliance with good corporate governance principles”.

“However, despite the Fidelity Insurance Cover taken by banks to address fraud perpetrated by staff, there is still need for the banks to further enhance their internal control and security measures, as the rising trend of E-Channels (online banking & card-related) fraud and forgeries in the industry remains a serious cause for concern to the corporation,” it added.