Exploring Revenue Sources For Infrastructural Developments

By Oyeniyi Iwakun

The Tafawa Balewa Square, the National Arts Theatre and some selected power plants under the National Integrated Power Projects are part of the key national assets the Federal Government has concluded plans to sell in order to generate sufficient revenue to finance the nation’s 2018 budget. This issue continues to generate dissatisfactory reactions from Nigerians but the governments seemingly lacks ideas as to how best to source funds.

Oftentimes, successive governments either see some projects of their predecessors as needless or ill-conceived hence, abandoning them or leave them at the mercy of civil servants usually inclined towards running them down. Critical government institutions and infrastructures like NICON Insurance, National Electric Power Authority (NEPA), Nigeria Telecommunications (NITEL) among others have been sold, some concessioned while others operated in partnership with the private sector since the return to civil rule in 1999.

The reasons for these decisions by government had been adduced to poor management and lack of cohesion among agencies and public officials saddled with the responsibilities of ensuring the smooth running and management of these basic institutions and gigantic infrastructures of our nation. While some of these privatized assets have fared better under their new owners in the private sector, others have become worse.

However, there is a growing need for the construction of new critical infrastructures and rehabilitation of the old ones in different sectors of the country to boost the nation’s economy. Nonetheless, it has become very clear to think outside the box because government seems not to be ready to put its limited resources to ameliorating these problems due to several reasons. It is then rational to go with some stakeholders who have argued in favour of devising alternative funding and management means for building critical infrastructures for sustainability and to boost the nation’s economy

Abreast of the situation of infrastructure decay and also to improve the mode and means of transport of humans, goods and services especially from the ports to other parts of the nation, the Nigeria Shippers Council (NSC) and the Federal Ministry of Transportation who have been at the forefront of promoting the Inland Dry Ports (IDP) and Truck Transit Parks (TTP) took a giant step recently by organizing a breakfast meeting with major policy makers and stakeholder in Lagos to discuss the possible means of financing the aforementioned projects in Nigeria.

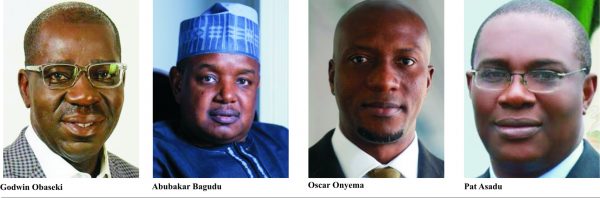

Speaking at the event, Mr. Oscar Onyema, the Chief Executive Officer (CEO) of the Nigerian Stock Exchange noted that the transport sector is one of the engines of growth and prosperity in any economy and in improving the quality and viability of the Nigeria’s transport infrastructure and services, there is need to reduce the cost of transportation in Nigeria, attract domestic and foreign investment into the country and expand access to economic opportunities. He opined that discussions about financing Nigerian transport infrastructure is imperative considering the transport infrastructure development funding gap which is estimated to be greater than Seven hundred and fifty (750) million dollars over the cost of the next thirty years. He argued that it is more important at this time the federal government has made a frown commitment to diversifying the nation’s economy away from its dependence on crude oil as its major export as well as growing strategic sectors of the economy including agriculture and tourism and given that the National budget is approximately twenty four (24) billion dollars and the required capital investment in transportation infrastructure is approximately twenty five (25) billion dollars. He posited that attracting private sector funds is the only way to bridge the finance gap. A process he said could take number of months including Public Private Partnerships (PPP) and full privatization, citing the Lekki-Epe expressway toll-roads concession project as good example which according to him, is Nigeria’s first ever PPP project.

“The Lekki concession company was able to secure more chance of financing to the tune of fifty (50) billion naira for the construction of phases of the project with the participation of several local and international financial institutions. Trenches which were regarded as ground breaking in Nigeria.

“From our perspective at the Nigerian services tune, we are committed to exploring and developing in varying ways to finance the nation transport infrastructure in order to accelerate the growth this sector of the economy. Special purpose vehicles can utilize the Nigerian stock exchange partners to gain access to low cost and more funding capital. This can be exchanged via public bond issuance by the oil companies or by incorporating certain companies to issue bonds and lot to proceed with the project funding. The special purpose vehicle involves the PPP project and can also utilize funding from listed funds, focused on PPP infrastructure investment. In general, the investment prospects of transportation infrastructure and policy.” he said

Mr. Onyema also posited that if the recently exposed draft rules by Pension commission (PENCOM) are issued, they will allow for up to 20% of accumulated pension assets which today is about 7.16trillion naira to be invested in infrastructure which doesn’t include financial investments from insurance, in savings and fund managers. As he is confident that the Nigerian stock exchange having implemented far reaching transformational policies aimed at providing products that align with investors requirements, increasing market access and ensuring a thorough and orderly market over the years coupled with the capital market that witnessed the growth of the Nigerian infrastructure debt fund which is built to raise two hundred (200) billion naira, a fund which has its own investment focus on traditional infrastructure sector. He believes it is primarily an ideal investment vehicle for the planned Truck Transit Parks (TTPs) and Inland Dry Port (IDPs).

“We believe that these achievements will improve investor’s confidence and would go a long way to support the federal ministry of transportation and the Nigeria Shippers Council (NCS) quest to unlock the private sector of investment required for financing the transport infrastructure gap. Looking ahead the Nigeria stock exchange will continue to seek way to open the market by actually working to launch an infrastructure fund that are having focuses on sectors like transport for connectivity. Facilities such as TTPs and IDPs are very imperative for any nation serious about fostering intra and cross border trade. Therefore, there must be a concerted effort to access the capital rate opportunity that exists within and outside capital market.” He concluded.

On his part, the former Kebbi State Governor, Senator Muhammad Adamu Aliero believes that having realized that there is serious deficit in the nation’s transport infrastructure, the needed measure to overcome the deficits is palliative for funds and according to him, government doesn’t have the funds. Hence, the question “how do we get these funds? The answer he said would be through the private sector even as he assured that the national assembly is prepared to come up with very strong legislation that will encourage the private sector to step into the TTP project. The senator who attributed the decay and failure of public infrastructures and institutions to lack of cooperation and corporate governance also called on the private investors to key into the project.

“Already, the NSC has come up with PPP molecule and let me warn here that the government has no business in either the IDPs or TTPs. It should therefore be the responsibilities of the private sector if you don’t want it to disappear because the moment government comes in, then there will be problem of management like we have seen in all government enterprises. IDPS are very viable, and the only thing that it request is to conduct feasibility study, once that is done, the investors will be willing to sponsor.

”I am happy that I am one of the first people that introduced PPP on road construction when I was the minister for federal Capital Territory (FCT). We all know that the Airport road and equally Kubwa road down to Abuja used to be only forests. I introduced the PPP on the construction and rehabilitation of these roads. We only provided forty percent {40%} of what is required to construct these roads from the private sector through the bond market which the last speaker talked about provided sixty percent (60%). I am happy now today; these roads are now completed and put into effective use. Or else, without these roads, Abuja would have been like what Lagos used to. Most of you are aware that in 2007, 2008, for you to come to Abuja by vehicle, it would take you two and a half hours and for you to also leave the city to Abuja it would take you the same but today, you can plough these roads for only twenty (20) to forty (40) minutes. This is what PPP project can do and I am sure that the same thing can be applied on the issue of TTP and IDP” he said

The Chairman, House Committee on Port Habours and Waterways, Hon Pat Asadu also identified with the previous commentators on the alternative financing models. He feared that the federal government currently rocked with financial crisis might find it extremely difficult to fund such project because of its capital intensive nature. He however urged stakeholders to look beyond the national budget because it has been tied to so many other projects even as he advised that the infrastructure deficits in the transport sector be seen not as a problem but an opportunity.

“It is not that the government doesn’t want to invest in it but because we don’t have the money in the national coffers. I think this session of national assembly have shown that we are ready to work with executive especially in the transport sector. We are strictly bound on the national transport commission bill because we understand how important that bill is to making the transport sector work well. So, we must provide environment for a private sector to come in and give us a better management. We must give our investors the assurances that whatever they are bringing into Nigeria would be safer, that the Nigerian economy would protect them and give them the needed support” he said.

The Chairman Senate Committee on Marine Transport, Senator Ahmed Sani supported his colleagues in their argument as he added that the Nigerian senate would be ready support private investors via appropriation and oversight functions and also announced that the senate would pass National Transport Commission (NTC), bill before the end of the year 2017.

Oh his part, Kebbi State Executive Governor, his excellecy, Abubakar Atiku Bagudu believed that the TTPs model is an arrangement that will at least do away with the problem of criminal gangs that strikes on the highways and hijack trucks. The governor saw the need to ask questions and address the key issues of why the real development is not happening? Why are the capital holders or investing public not financing the project? Is it that they are unaware or unappreciative or yet to be convinced about the financing opportunity in the project? Despite being so commonsensical and easy, yet it is not happening as expected. To him, something is amazing for everyone to see and the practicable solution is to create and demonstrate within our own economy, and investors will come.

“I think the policy environment under president Muhammedu Buhari and the vice president who is also the chairman of INEC as we interact at the national economic council seems to have the policy tools and viability that can drive the policy forward.

“The decision by the national council to even in this era of depression found a sovereign wealth fund with an additional five hundred million (500) dollars is a significant signal that we believe and have confidence in the opportunities of the Nigeria economy. What involves all of us, especially the financial sector and the capital market is to also show that these opportunities are not just stated in document but really provide avenues for people to put money and get money for sustainable money. If we get our infrastructure right, we will dominate the trade and also be current among other incentives. We can do it quicker and I am sure all state governments that are here and otherwise represented would be willing to partake and participate. The private sector is quite active.” He said

“I believe that Sokoto state government is most willing to partner any foreign investor to establish this TTP and Dry ports in Ndena because the state government had wanted to do it by itself but like it has been observed earlier that government has no business in doing business and that several establishments by government are not well managed” he said

Managing Director of the Edo City Transport Ltd. Mrs. Edugie Agbonlahor who represented Governor Godwin Obaseki announced that about 50 hectares of land had been set aside for the TTP. And for IDP, a private investor has already put up a structure within Edo state.

“A committee has been set up and the essence of the committee is to seek for investors to come in and partner because this TTP is very necessary considering the location of Edo state in Nigeria; the north, south are not far from it and must pass through it. That means it is a transportation hub, thus more profitable to invest in this IDP and TTP because of what has already be put in place in the state. We want to encourage all private investors to come and partner with us” he said.

Copyright MMS Plus.

All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express written permission from KINGS COMMUNICATIONS LIMITED.