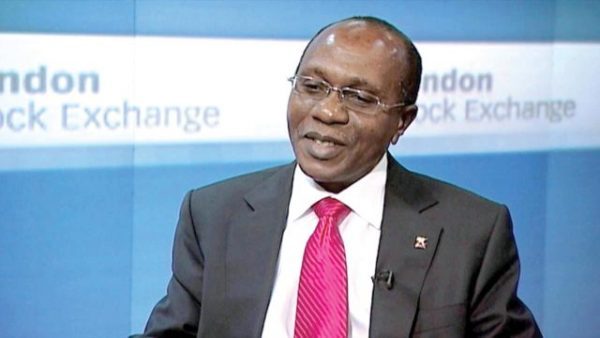

Emefiele Rules Out Third Naira Devaluation

Governor of the Central Bank of Nigeria (CBN), Mr. Godwin Emefiele recently ruled out a further naira devaluation and urged Nigerians not to panic about a government order, which risks draining billions of dollars from the financial system.

In an interview with the media, Emefiele said the apex bank was ready to inject liquidity if needed into the inter-bank market, which dried up early this week following the directive to government departments to move their funds from commercial banks into a Treasury Single Account (TSA) at the central bank.

The policy is part of new President Muhammadu Buhari’s drive to fight corruption, although analysts say it could suck up as much as 10 per cent of banking sector deposits the economy which may hurt banks’ liquidity ratios.

With global oil prices tumbling, banks and companies are already struggling with the consequences of a dive in Nigeria’s crude oil revenues that has hit the naira currency and triggered flows of capital out of the country.

This crisis was however heightened with last week’s decision by JP Morgan to kick Nigeria out of its influential Emerging Markets Bond Index due to restrictions it imposed on the currency market to support the naira and preserve its foreign reserves. Since taking office in May, Buhari has vowed to rein in Nigeria’s dependency on oil exports, which account for 90 per cent of foreign currency earnings. However, he has faced criticism from investors for failing to appoint a cabinet yet or outline concrete policies.

Amid confusion over the implementation of the single account policy, overnight inter-bank lending rates spiked to 200 per cent, but Emefiele refused to admit the policy had provoked a liquidity crisis.

“There is no shortage of liquidity,” Emefiele said, pointing to an oversubscribed sale of treasury bills on Wednesday. “A spike is a momentary action. It’s sentiment. I do not think there is any need for anybody to panic,” he added.

Nevertheless, the inter-bank naira market was paralysed for a third day last week, with banks unwilling to lend to each other, even when rates fell back to 20-30 per cent.

In a sign of the financial ructions, commercial bank cash balances with the central bank that are normally earmarked for foreign exchange or bond purchases plunged to N173 billion on Thursday from N486 billion two days ago.

Analysts had predicted that the TSA edict could suck N1.2 trillion ($6 billion) out of the commercial banking system. Emefiele said the amount would be less than N1 trillion, although he did not give details beyond saying the measure was designed to root out graft.

His comments did not instill confidence in the new rules among economists. “It’s an example of the government deciding on a policy without thinking through the mechanics of how its implementation will work,” said Alan Cameron at Exotix, a London-based specialist in frontier markets – a higher risk subset of emerging economies.

Emefiele ruled out a further devaluation of the naira following two in the past year due to the collapse in oil revenues, insisting that its current level of N197 to the dollar would be held.

“There will not be a devaluation because right now the currency is appropriately priced,” he said.

In a series of unconventional interventions to protect the naira, the bank has blocked access to foreign currency for the importation of 41 items ranging from soap and toothpicks to cement and private jets.

“There is no intention to review any of those items on the 41 list because we believe that they are items that can be produced within the country,” he said, adding that the list might grow.

Analysts dismissed the move as ill-thought out economic shock therapy that would unleash inflation since Nigeria does not have the factories and infrastructure to make many of the items on the list. “Problems from this policy are just going to grow and grow,” said Kevin Daly, a portfolio manager at Aberdeen Asset Management in London.

Annual inflation hit 9.3 per cent in August, above the central bank’s target band.

Emefiele rejected complaints from firms about the difficulty of getting hold of dollars and ruled out the possibility of a default by any company with dollar-denominated debt, saying the bank could “write their cheque and pay them anytime they want.”