MARKET UPDATE

ECONOMY: Nigeria’s Fiscal Woes Deepens as Total Public Debt Hit N121.67trn in Q1 2024……

For Cowry Research, the underlying driver of escalating debt levels stems from Nigeria’s constrained revenue base, prompting concerns regarding the government’s ability to fulfill its debt obligations. Notably, the high cost associated with servicing this debt, which is further hinged on the Naira devaluation, has resulted in a significant allocation of government revenues towards debt payments, intensifying the fiscal challenge.

EQUITIES MARKET: : The Bears Resurface as Investors Cherry-pick; ASI Retreats 0.18% w/w

Looking ahead to the next week, we expect the local bourse to trade in mixed sentiment on the back of low valuation and portfolio repositioning for value stocks as investors continue to exhibit a wait and see approach.

ECONOMY: Nigeria’s Fiscal Woes Deepens as Total Public Debt Hit N121.67trn in Q1 2024…

The latest public debt statistics published by the Debt Management Office showed that Nigeria is facing escalating debt levels, with the federal and state governments total debts rising by N24.33 trillion, a 24.99% quarter-on-quarter increase within the first three months of 2024, reaching N121.67 trillion ($91.46 billion) as at March 31, 2024, up from N97.34 trillion ($108.23 billion) in December 31, 2023.

This surge was driven by the effects of naira depreciation and voracious borrowing by the federal government to partially finance the 2024 budget deficit, placing Nigeria on the brink of a fiscal cliff.

Accordingly, total domestic debt stood at N65.65 trillion ($46.29 billion), accounting for 54% of the total public debt, while external debt printed at N56.02 trillion ($42.12 billion), representing 46%. Additionally, the 36 states and the FCT have an external debt of $3.1 billion and a domestic debt of N4.068 trillion.

Over the past 12 months, Nigeria has secured $4.95 billion in loans from the World Bank, despite growing worries about the increasing costs associated with servicing its external debt. The government anticipates additional loan approvals worth $4.4 billion from the international financial institution and the African Development Bank over the next year.

Meanwhile, the Bank, before now, has approved funding for six projects in Nigeria, including $750 million for power sector financing, $500 million for women’s empowerment, $700 million for the girl-child education, $750 million for renewable energy solutions, $750 million for resource mobilisation reforms, and $1.5 billion for economic stabilization reforms. These projects have contributed to the country’s increasing debt levels

The local currency devaluation by the CBN contributed significantly to the increase in Nigeria’s total public debt. Regardless the exchange rate effects, the domestic debt component of the total public debt rose by 11.05% (N6.53 trillion), from N59.12 trillion on December 31, 2023, to N65.65 trillion on March 31, 2024. According to the DMO, the increase was from new borrowing to part-finance the 2024 budget deficit and securitization of a portion of the N7.3 trillion Ways and Means advances at the Central Bank of Nigeria.

For Cowry Research, the underlying driver of escalating debt levels stems from Nigeria’s constrained revenue base, prompting concerns regarding the government’s ability to fulfill its debt obligations. Notably, the high cost associated with servicing this debt, which is further hinged on the Naira devaluation, has resulted in a significant allocation of government revenues towards debt payments, intensifying the fiscal challenge.

As we have noted in our 2024 Outlook report, these challenges are further compounded by the foreign exchange harmonisation and revaluation efforts by the Central Bank of Nigeria, heightening the cost of debt servicing. Given that Nigeria’s debt is denominated in both domestic and foreign currencies, the nation is vulnerable to external shocks, including fluctuations in interest rates and exchange rates. These dynamics underscore the critical imperative for a sustainable debt management strategy and the urgency of diversifying revenue sources to bolster fiscal resilience and mitigate risks associated with the expanding debt burden. Despite ongoing reforms, such as the removal of fuel subsidies and aggressive revenue generation efforts, the gradual uptick in the total debt stock, especially in external debt, underscores the persistent reliance on borrowing to meet budgetary shortfalls and financial obligations.

EQUITIES MARKET: The Bears Resurface as Investors Cherry-pick; ASI Retreats 0.18% w/w…

It was a see-saw movement as the stock market, this week, closed with negative optimism the grip of the bears held the benchmark index, reversing last week’s gains by 0.18% week on week to 99,743.05 points as portfolio rebalancing continues for investors seeking alpha in the market. Thus, the market players continue to digest the economic data about Nigeria’s economy in what will influence their investment decisions.

Consequently, the market capitalisation of listed equities retreated by 0.18% week on week to N56.42 trillion as investors sell exhibited mixed sentiment with boisterous market activities level. However, a total of N103.08 billion was lost by equity investors from two out of the three sessions this week while the year-to-date return of the index printed at 33.39%.

This week, trading activities maintained a positive trajectory for the week, evidenced by further improvement in the total volume and value of weekly trades.

Consequently, the total traded volume advanced by 25.4% week-on-week to 3.30 billion units, while the total weekly traded value increased sharply by 21.8% week on week to N53.16 billion. However, just like the prior week, the total number of trades for the week declined by 18.3% week on week to 27,536 deals.

This week, the sectoral performance was largely positive, with the NGX-Consumer Goods, NGX-Oil & Gas and NGX-Industrial Goods indices leading the gainers with marginal increases of 0.29%, 0.21% and 0.10% respectively. The stocks contributing to these gains included GUINNESS, PRESCO, ETERNA, CHAMPION, CUTIX, and TOTAL. On the contrary, investors dumped financial stocks as we saw the NGX-Insurance, NGXBanking indices, pared last week’s gains by 1.31% and 0.04% respectively on the back of sell pressure witnessed in the sectors which led to negative price movements in VFDGROUP, FBNH, AIICO, FIDELITYBNK and MANSARD.

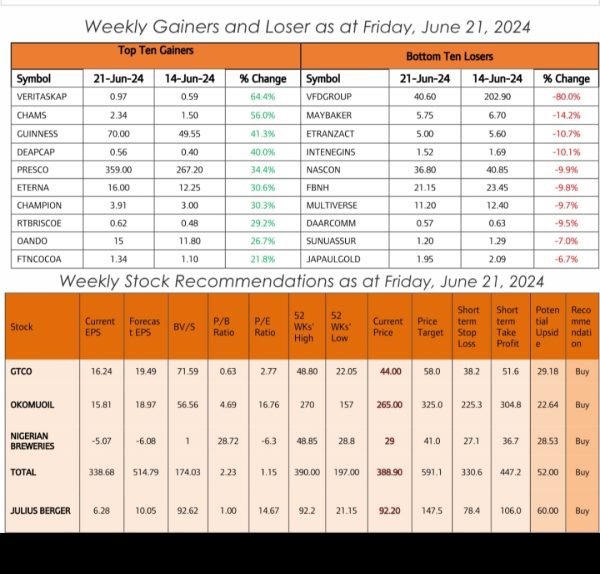

At the close of the week, notable performers such as VERITASKAP (+64%), CHAMS (+56%), GUINNESS (+41%), DEAPCAP (+40%), and PRESCO (+34%) emerged as the best performing securities, driven by positive activities in these stocks, which propelled their price movements. Conversely, negative investor sentiment led to sell-offs in VFDGROUP (-80%), MAYBAKER (-14%), ETRANZACT (-11%), INTENEGINS (-10%), and NASCON (-10%), positioning these stocks as the top losers for the week.

Looking ahead to the next week, we expect the local bourse to trade in mixed sentiment on the back of low valuation and portfolio repositioning for value stocks as investors continue to exhibit a wait and see approach.

As trading volume patterns continue to fluctuate, suggesting buying interest in some sectors and profit-taking in others amidst a wait-and-see attitude among market players, investors are advised to trade in stocks of companies with sound fundamentals.