ECONOMY: Nigeria’s Escalating Debt Levels Hit N87.4trn

as FG’s Heavy Borrowings Stagger Increasingly….

A look into the current debt report published by the Debt Management Office (DMO) and the National Bureau of Statistics, Nigeria’s total public debt, as of the second quarter of 2023, has surged to N87.38 trillion ($113.42 billion). This figure encompasses both domestic and external debts of the Federal Government, the 36 states, and the Federal Capital Territory. Notably, this reflects a staggering increase of 75.29%, equivalent to N37.53 trillion, from the previous quarter ending in March 2023.

To break down Nigeria’s public debt profile, domestic debt constitutes the majority at 62%, amounting to N54.13 trillion ($70.26 billion), while external debt accounts for the remaining 38%, totaling N33.25 trillion ($43.16 billion). Meanwhile, from the state’s profiles, Lagos state recorded the highest domestic debt in Q2 2023 with N996.44 billion, followed by Delta with N465.40 billion while Jigawa state recorded the lowest domestic debt with N43.13 billion, followed by Kebbi with N60.94 billion. In addition, Lagos state recorded the highest external debt with $1.26 billion, followed by Kaduna with $569.38 million. On the other hand, Borno state had the least external debt with $18.75 million, followed by Taraba with $21.92 million.

The Nigerian government has been borrowing heavily in recent years to finance infrastructure projects and budget deficits as well as some recurrent expenditures which has resulted in a spike in governance cost. However, the country’s debt burden has become increasingly unsustainable, and there are concerns about its ability to repay its debts.

A closer analysis of the Federal Government’s debt profile reveals that a significant contributor to this surge in public debt is the inclusion of N22.71 trillion in Ways and Means Advances extended by the Central Bank of Nigeria to the Federal Government. It’s worth noting that these advances were previously excluded from official public debt calculations. However, a pivotal development occurred in May 2023 when the National Assembly approved their securitization, effectively adding them to the public debt stock.

Furthermore, Nigeria’s limited revenue base has remained a key driver of the escalating debt levels, which has raised apprehensions regarding the country’s ability to meet its debt obligations. Additionally, the high cost associated with servicing this debt has led to a substantial portion of government revenues being allocated to debt servicing. Also, a recent foreign exchange harmonization and revaluation effort by the Central Bank of Nigeria has further exacerbated the cost of debt servicing. This is particularly concerning as Nigeria’s debt is denominated in both domestic and foreign currencies, rendering it vulnerable to external shocks, such as fluctuations in interest rates and exchange rates.

Although, the Nigerian government has stated that it plans to reduce its reliance on borrowing in the future and to focus on improving its revenue generation capacity, Cowry Research opines that proactive steps needs to be taken to effectively address these revenue challenges and ensure that its debt is sustainable. Key steps may involve reducing the budget deficit, increasing tax revenue, and diversifying the economy. However, in response to the revenue challenges that has led to escalating debts levels, the government has initiated a series of reforms aimed at improving the efficiency of public spending. These reforms include the removal of fuel subsidies and aggressive efforts to bolster revenue generation, as affirmed by the current administration.

EQUITIES MARKET: Dampened Investors’ Sentiments Reign As FTSE Russell Downgrades Nigeria’s Index….

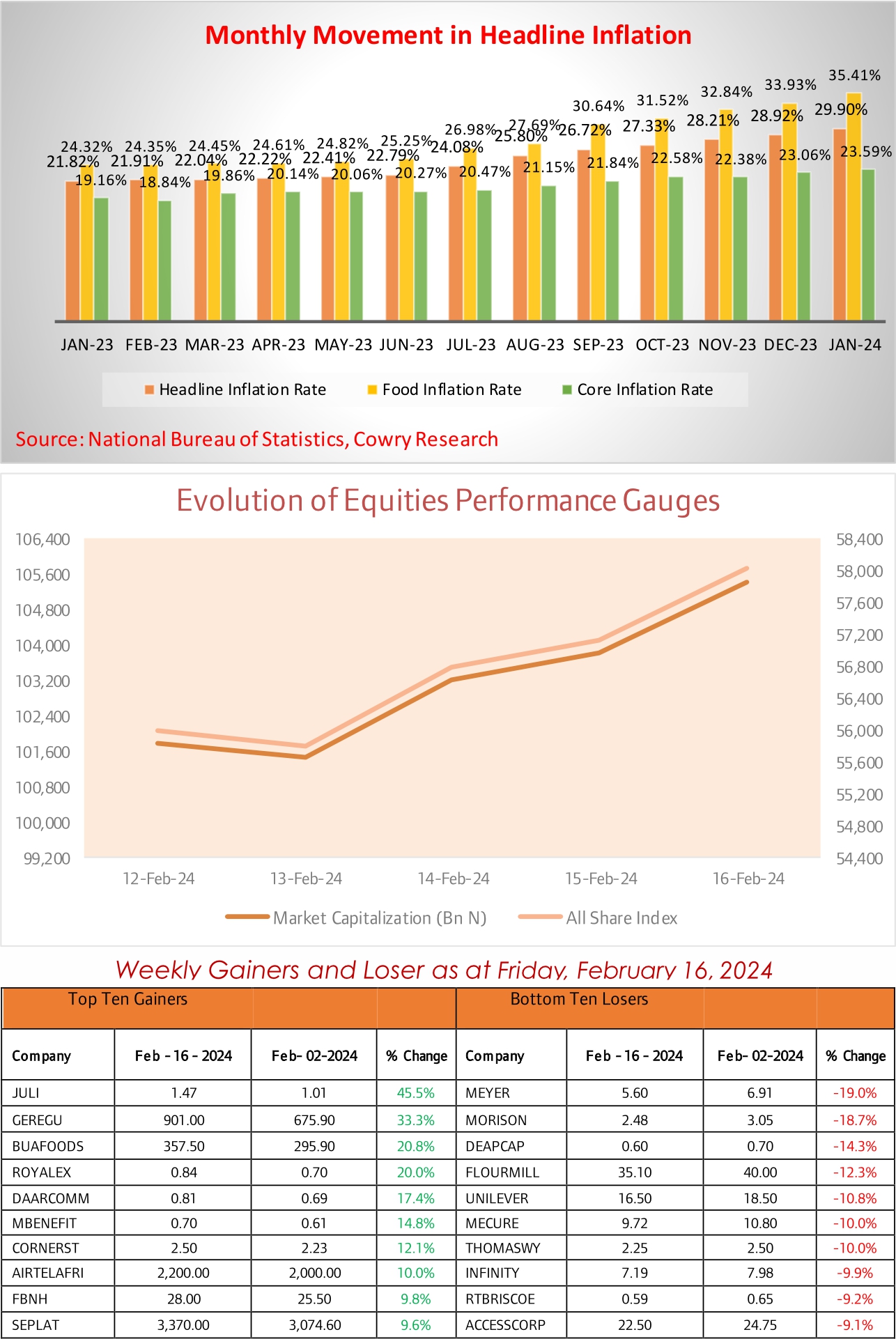

As the third quarter reporting season draws closer and investors take a bet on the back of recently published macroeconomic data, bearish momentum and pattern pervaded the domestic market this week with the benchmark index recording a 1.10% week-on-week loss, culminating to a decline in the ASI to 67,395.74 points. This comes as FTSE Russell, a global index provider, opted to downgrade Nigeria’s equity index from “Frontier” to “Unclassified” market status on September 18, 2023 on the back of Nigeria’s ongoing foreign exchange (FX) crisis, which has posed formidable hurdles for international institutional investors seeking to repatriate their capital from the nation and this means that Nigerian stocks will be excluded from the FTSE Frontier Index Series, the FTSE Frontier 50 Index, and others.

Concomitantly, the total market capitalization of listed equities experienced a decline of 1.10% week-on-week, descending to N36.89 trillion compared to the previous week’s figure of N37.40 trillion. This decrease equates to a substantial loss of over N400 billion for equity investors. Of noteworthy mention is the commendable year-to-date return of the All-Share Index (ASI), which printed at 31.50%. This figure underscores the commendable resilience demonstrated by the Nigerian market amidst the prevailing global uncertainties.

Turning our attention to sectoral performance, the week unveiled a largely bearish outing. The Insurance sector emerged as the lone gainer this week by 0.46% week on week. This was primarily attributed to price appreciations in CORNERST and CHIPLC. On the contrary, the banking index was hardest hit this week as the index lost 3.24% week on week in reaction to the FTSE Russell’s downgrade which resulted in pressured sell-offs in ZENITH, GTCO. Also, the Oil & Gas, Consumer goods and Industrial sectors also exhibited signs of decline, albeit to a lesser extent, with losses of 2.02%, 1.84% and 0.28% respectively.

Trading activity throughout the week remained characterized by buoyant sentiments, as evidenced by robust trade volumes and values, despite the market experiencing gains in only 2 out of 5 trading sessions. The weekly tally of deals exhibited a 3.48% week-on-week increase, totaling 44,654 deals. Moreover, the average traded volume witnessed a modest weekly increase of 14.17%, settling at 2.93 billion units. Notably, the weekly average value displayed a more substantial uptick, with a 7.80% increase, reaching a value of N47.45 billion compared to the preceding week’s figure of N44.01 billion.

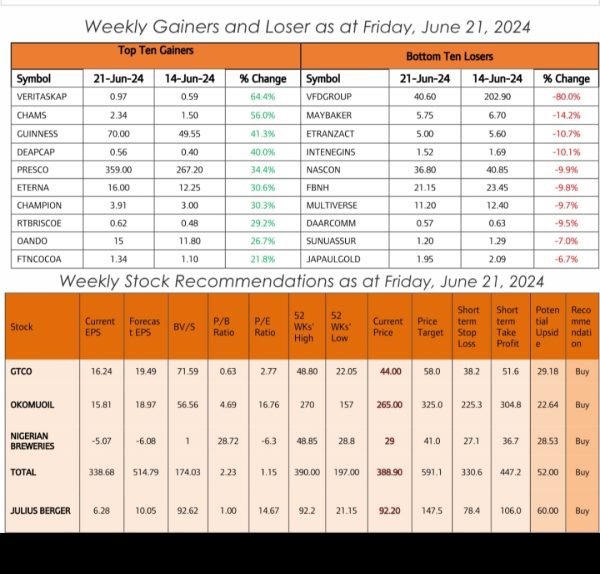

As the trading week concluded, several stocks showcased remarkable positive rallies, which significantly bolstered overall market sentiment. Leading the charge was OANDO, with an astounding surge of 43%, closely trailed by CORNERST at 13%, and NNFM at 12%. These exceptional performances undoubtedly caught the attention of value investors with positive rally. In contrast, ABCTRANS faced a downturn of 34%, while ETRANZACT and LEARNAFRCA experienced respective declines of 27% and 15% due to negative price movements.

In the upcoming week, market sentiment is likely to be diverse as investors engage in bargain hunting ahead of the highly anticipated third-quarter earnings season which draws closer. This will be driven by reactions on the just published inflation data from the NBS, which has remained elevated, potentially prompting further interest rate adjustments by the CBN at its upcoming MPC meeting later this month. Meanwhile, we continue to advise investors on taking positions in stocks with sound fundamentals.

FOREX MARKET: Naira Skids Across FX Segments Amidst Efforts to Clear FX Backlogs…..

In the Nigerian foreign exchange market this week, the Central Bank of Nigeria (CBN) undertook a review of recent changes to the foreign exchange (FX) regime. This review has revealed a promising prospect for Nigerian banks to profit from the new policy. The potential for increased value of banks’ foreign currency (FCY) assets and liabilities in Nigerian naira is at the heart of this opportunity. As a result of the FX policy adjustment, fluctuations in exchange rates are expected to positively impact the valuation of these FCY assets held by banks. This development has the potential to yield significant benefits for both the banking sector and the broader Nigerian economy.

By the close of the trading week, the naira lost strength by 4.78% week-on-week at the official market, closing at N756.91/$1 while at the parallel market, the naira depreciated by 2.69% week-on-week to N955/$1. This depreciation was driven by the continued search for the dollar by forex users in alternative forex markets, given the limited supply from the apex bank.

Meanwhile, at the FMDQ Securities Exchange (SE) FX Futures Contract Market, the naira exhibited weakness against the US dollar across various contract tenors. Notably, forward rates in dollar terms appreciated by 2.18%, 2.30%, 2.42%, 2.77%, and 3.39% for the 1-month, 2-month, 3-month, 6-month, and 12-month contract tenors, respectively. This upward movement in forward rates was a result of increased demand for the dollar across these various tenors.

Shifting our focus to the oil market, crude oil prices looked set for a third consecutive week of bullish rally and was spurred by growing demand and supply mismatch and the latest industrial output report. As a response, crude oil prices have experienced a slight increase, with WTI crude trading at $90.84 per barrel and Brent crude at $93.96 per barrel on Friday. Additionally, the price of Nigerian Bonny Light crude oil closed positively at $98.19 per barrel, up from the previous week’s $94.20 per barrel.

In the coming week, Cowry Research anticipate the naira to trade in a relatively positive band to show further appreciation at the various fx markets barring any distortions while the apex bank maintains its interventions to shore up the naira value. Meanwhile, the CBN’s interventions in the foreign exchange market have played a crucial role in maintaining the stability of the Nigerian naira, even in the face of fluctuating oil prices.

MONEY MARKET: NITTY Moves Upward in Tandem with Stop Rates for 364-Day Maturity…

In the just concluded week, CBN rolled over maturing T-bills worth N152.20 billion in the primary market. In line with our expectation, the stop rate for the 91-day and 364-day bills further rose to 6.50% (from 4.50%), and 12.98% (from 12.55%), respectively. However, stop rates for the 182-day bills remained unchanged at 7.00%. Notably, demand improved, as implied by a 4.23x bid-to-cover ratio (prior: 4.08x).

We saw yields in the secondary market rise for most maturities tracked. Notably, NITTY for 1 month, 3 months, 6 months, and 12 months maturities leaped to 3.86% (from 3.38%), 5.08% (from 4.65%), 7.57% (from 7.43%), and 14.50% (from 13.91%) respectively.

Meanwhile, NIBOR moved in mixed directions, with NIBOR for overnight, 1-month, and 3 months maturities climbing to 25.17% (from 11.45%), and 10.17% (from 9.77%), respectively, while NIBOR for 6 months and 12 months tenor buckets moderated to 10.67% (from 11.15%) and 11.00% (from 11.75%), respectively.

In the new week, we expect activity in the money market to be bearish amid limited maturing Treasury and OMO bills…

BOND MARKET: Stop Rates on FGN Papers Rise Amid Soft Demand…

In the just concluded week, the DMO allotted N316.49 billion (inclusive of noncompetitive allotments) worth of bonds across 10-year, 14.55% FGN APR 2029 worth N43.65 billion; 10-year, 14.70% FGN JUN 2033 worth N75.45 billion; 15-year, 15.45% FGN JUN 2038 worth N25.69 billion, and the 30-year, 15.70% FGN APR 2053 worth N171.71 billion, with marginal rates increasing by 14.50%(from 13.85%), 15.45%(from 15.00%), 15.55% (from 15.20%) and 16.25%(from 15.85%) respectively as investors demanded higher rate.

Notably, the total subscription amounted to N290.99.03 billion (its lowest since October 2022), while the auction’s bid-tocover ratio, a gauge of demand, fell to 0.92x (from 1.36x).

Similarly, the values of FGN bonds traded at the secondary market decreased as yields expanded week-on-week for all maturities tracked in tandem with the Primary market rates. Specifically, the 10-year 16.29% FGN MAR 2027, the 15-year 12.50% FGN MAR 2035, the 20-year 16.25% FGN APR 2037 and the 30-year 12.98% FGN MAR 2050 debts lost N1.71, N0.37, N0.66 and N2.51, respectively, while their corresponding yields expanded to 13.62% (from 13.03%), 14.92% (from 14.84%), 15.42% (from 15.30%) and 15.83% (from 15.35%), respectively.

Meanwhile, the value of FGN Eurobonds traded on the international capital market depreciated for all maturities tracked, fueled by bearish sentiment stemming from Nigeria’s recent FTSE Russell downgrade. Notably, the 10-year, 6.50% NOV 28, 2027, the 20-year, 7.69% FEB 23 2038, and the 30-year, 7.62% NOV 28 2047 bonds experienced losses of USD 0.28, USD 0.16, and USD 0.10, respectively, leading to expanded yields of 10.85% (up from 10.74%), 11.67% (up from 11.64%), and 11.41% (up from 11.39%).

In the new week, we expect local OTC bond prices to depreciate (and yields to rise) amid an expected strain in financial system liquidity…