CBN charges ABCON on effective self-regulation, market intelligence

The Central Bank of Nigeria (CBN) has challenged the Association of Bureaux De Change Operators of Nigeria (ABCON) to evolve an effective self-regulation that would ensure full compliance of the operators.

ABCON, the umbrella body of the nation’s over 4,500 Bureaux De Change (BDCs), licensed by the CBN, received the directive in Lagos, during the Inter-Governmental Action Group against Money Laundering in West Africa (GIABA) Mutual Evaluation Exercise Sensitisation workshop for South West.

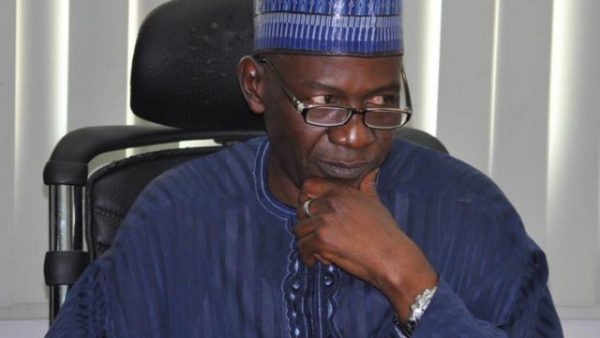

Apex bank’s Deputy Director, Other Financial Institutions Supervision Department, Mustafa Haruna, said there was need for BDCs to ensure compliance with extant Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) laws and regulations to mitigate the risks and vulnerabilities in the sub-sector.

He said that ABCON should develop and implement a Code of Conduct for members to promote ethical practices and transparency in the sector, while also continually advising the apex bank on market intelligence on key industry issues.

Haruna said the BDC sub-sector is a critical component of the Nigerian financial market, adding that the cash-based nature of the transactions and other identified deficiencies make it highly vulnerable to ML/TF risk.

But ABCON President, Dr. Aminu Gwadabe, said that ABCON had consistently advised operators to put in place and implement a system of internal policies, procedures and controls, including Know Your Customer, Customer Due Diligence and reporting of all suspicious transactions to regulators.

He said that ABCON is also training BDCs on regular basis on the need to keep transaction records, and get a designated compliance officer that has day-to-day oversight over AML/CFT programme.

According to him, group had over the years, established itself as a key player in the foreign exchange market and made several commitments and sacrifices to ensure that the sector continues to thrive, while its members follow global best practices.

Gwadabe affirmed that the operators have and will continue to meet compliance requirements specified by Financial Action Task Force (FATF) and local regulators, adding that ABCON, in February, launched its Live Run Automation Portal in Lagos, a technology that automates all BDC Operations with those of Nigeria Inter-Bank Settlement System (NIBSS), NFIU and the CBN to improve compliance.