2023 Half Year Review: Rail Dips By 49%, Road Up By 8% As CPPE Calls For Import Duty Concessions

The Centre for the Promotion of Private Enterprise(CPPE) has called on the Federal Government to make urgent interventions in the economy to address the negative impact of the fuel subsidy removal, harmonization of the foreign exchange windows and the introduction of a couple of new taxes.

Meanwhile, the surging negative economic variables in the global and Nigeria’s economy foisted contraction in the last half year on some subsectors. They are: Livestock, rail transportation, insurance, textile and oil refining, while the manufacturing, chemical, pharmaceutical, vehicle assembly, road transport, information and communications technology(ICT), real estate, financial institution sectors posted positive growth.

Presenting its 2023 half year economic review, CPPE stated that there was urgent need for a mixed direct interventions to mitigate the soaring costs of living and the escalating operating costs for businesses, all occasioned by inflationary pressure.

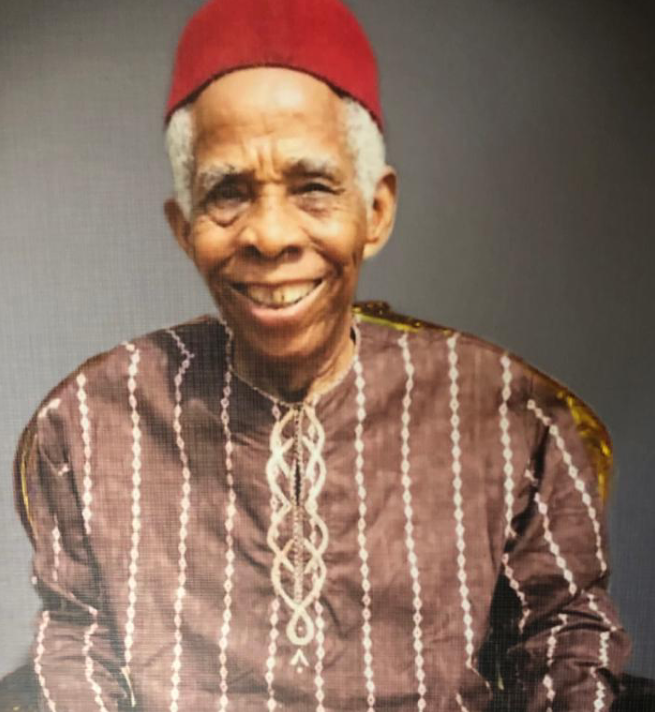

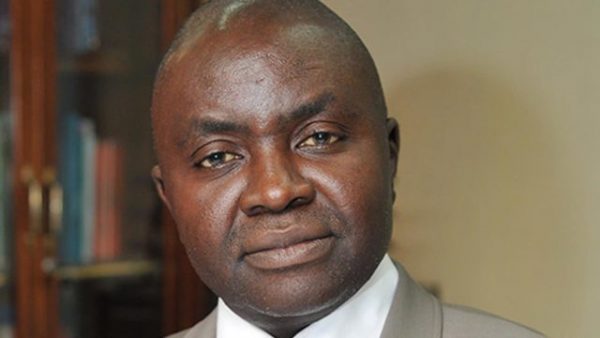

According to the Director and Chief Executive Officer of CPPE, Dr. Muda Yusuf, “The Tinubu administration needs to promptly deploy measures to mitigate the current headwinds inflicted by the current reforms. The interventions should be a mix of direct interventions, tax incentives for low-income employees and small businesses, reduction in import duty on some critical intermediate products for key sectors of the economy, import duty concessions for the transportation, health, power and energy sectors.

“The improved fiscal space created by the reforms should make these mitigating measures feasible and they have to be implemented urgently in order to give the current reforms a human face.

He observed that the inflationary pressures may intensify in the near term, the exchange rate may come under pressure in the short term as forex demand backlog exerts pressure on the official forex window, noting however that the pressure is expected to ease before the end of the year.

Predicting that this would pave way for an equilibrium exchange rate which would be more tolerable and sustainable, he called the Central Bank of Nigeria (CBN) to put in place a sustainable intervention framework to moderate the volatility in the forex market

Applauding the policies for having prospects for recovery and growth, he further observed that the reforms has increased investors’ confidence and given indication for improvement in the fiscal space and hope for better economic governance.

On the performance of the economy in the last half year, the Centre noted that the Gross Domestic Product (GDP) growth remained weak and fragile as it slowed to 2.31% in the first quarter of 2023, from 3.5% in the fourth quarter of 2022. Key sectors that contracted included agriculture which contracted by 0.9%, the first time in about a decade.

The livestock subsector was the worst hit as it contracted by a staggering 30.6%. Other sectors that contracted include oil refining which contracted by 35.8%; textiles, 3.7%; rail transportation, 49%; and Insurance, 8%.

“Sectors that posted positive growth numbers were manufacturing , which grew by a marginal 1.6%; food and beverage, 3.9%; chemical and pharmaceutical, 6.2%; vehicle assembly, 5.4%; road transport, 8%; ICT, 11%; financial institutions, 25%; and real estate, 1.7%,” the report stated.

The Centre attributed this mixture of contraction and growth to the Nigerian economy which was impacted by diverse global and domestic variables in the first half of the year. Major global factors were the Russian Ukraine war which continues to exacerbate energy costs and fueling inflation globally; the persistent monetary tightening in the advanced economies aimed at curbing a rather protracted inflationary pressure; and the worsening geopolitical tension triggered by the war in Ukraine.

“There is also a growing fragmentation of the global economy amid increasing anti-globalization sentiments, especially in the United States and Europe.

“The tight global monetary conditions had made access to global capital costly and difficult for developing economies. It also triggered global capital flow reversals from emerging economies. The phenomenon has weakening effect on the domestic currencies of the developing countries. These global headwinds had a dampening effect on economic growth in the first half of the year.

“On the domestic front, the major headwinds to growth were the naira redesign policy of the central bank, persistent dysfunctional foreign exchange policy, the political transition processes, weak recovery of oil production and the intractable challenge of insecurity in parts of the country,” CPPE added.