By Frank Odinukaeze

Evangelist Leonard Ogamba is the newly elected President of the Shippers’Association Lagos State. A lawyer, an author,a maritime consultant and a shipper, Ogamba holds a Master degree in Transport Planning and a Master of Laws(LL.M.) degree respectively. MMS Plus in its usual manner caught up with him shortly after he was inaugurated as the,5th President of the foremost shippers association. He picked holes in some of government policies which according to him make doing business in Nigerian ports rather expensive

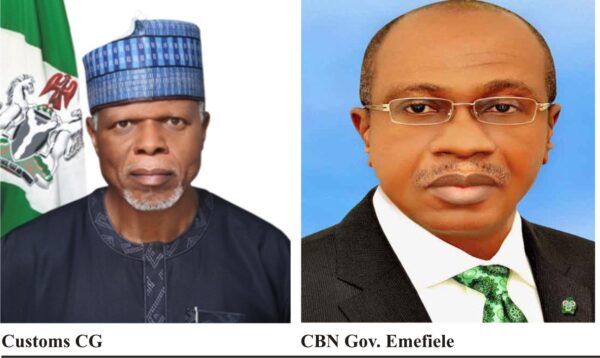

Find out why Central Bank of Nigeria(CBN) and the Nigeria Customs Service(NCS) should be blamed for increased smuggling in the country. He spoke with Frank Odinukaeze. Enjoy it.

Congratulations on your election and inauguration as the president of SALS.So, what are you bringing on board? What should your members expect from your government?

My vision is to reposition the Shippers’ Association Lagos State ( SALS) to meet the yearnings and aspirations of members, particularly in Lagos State.

We will do whatever we can to bring down the cost of doing business in Nigerian ports.

It’s on record that 2018,World Bank study on Logistics Performance Index(LPI),Nigeria came 110 out of 160 countries sampled. It is not a good idea. Even some time ago, the Managing Director of National Inland Waterways Authority(NIWA) had a press conference citing the reasons why Nigerian goods are rejected abroad and one of the reasons is that the goods stayed more in Nigerian ports,especially perishable items. By the time they came into the port they were of high quality,but by the time they get abroad, they become bad. So we are joining in that line to see what we can do, because the concession agreement is still there. If you are giving an area in the port, you are supposed to know the size of your domain. We have observed that most of these private terminal operators are bringing in containers to their bonded warehouses, outside the port. This is a contravention of contract of afreightment which is based on port to port( PTP).

Therefore, even by the virtue of the Nigeria legal notice, that before you can move that container from the port of discharge, to bonded warehouse, which is outside the port of destination, it should be by the consent of the cargo owner or the consignee .This has not been happening. We are going to address it. If you are going to take my container outside the port, once the shipper has entered into contract of afreightment with the carrier to take his container to a designated place, then the next day, the container will be taken for example to Lekki, without my consent. This is additional financial obligations on the part of the shipper. We are going to address it also. Furthermore, we also observed from experience that Nigerian shippers, most of them, do not know their rights. Most of them do not understand (INCOTERMS) i.e. international commercial terms that govern international merchant shipping. So it’s one of the road maps to educate them on their rights and obligations as well as to inform them of the shippers’ friendly conference on rules. For instance, Hamburg rules,is preferred to all rules in terms of claims. So we are going to do that. We are going to organize workshops and seminars, in order to inform them of these things I have mentioned.

Most economies in the world today rely heavily on export. Your association, Shippers Association Lagos State (SALS) what are you going to do to improve export to the betterment of the economy?

On the issue of export like I mentioned before, it’s very unfortunate that the Nigerian Shippers’ Council (NSC) was not a party to port concession arrangement . It’s on record and its consequence, is the challenges that exporters amongst us are having, and they the NSC, have little or nothing to do about it. When you look at the characteristics of the products that are being exported they are basically raw materials, the reasons being that, there is no electricity, no technology to process these raw materials into semi or finished products. When you google on the analysis of export of other countries, you see that the export increases the revenue base of any country. It is not raw material. They are semi finished or finished products. So we are going to put up a position paper on the enabling environment for exporters in the country. That is what we can do. We have to advice the policy-makers .This and that are our observations from experience. These are the things we want you to put in place so that there will be ease of doing business as far as the ports are concerned.

What are the challenges the shippers are facing particularly your association?

I have mentioned about two or three of them. Another is non- compliance with the provision of the Act 20 of 2003.

For instance, the most current is the e-valuation or e-invoicing of the CBN. That particular policy contravenes not only contract of afreightment, it contravenes General Agreement of Trade and Tariff (GATT ) principle of valuation Article 7and on both GATT and Act 20,2003, the basis for appraisement Of customs duty as transaction value. And what is transaction value? Transaction value is that price of the goods in the exporter ‘s country.NCS for some years ,with the introduction of e-valuation or e-invoicing based on benchmarking matrix, has refused to comply with Customs and Excise Management Act(CEMA) notice 30 , paragraph 5, which provides for allowable deductions from the basic price,such as second hand motor vehicles based on the year of manufacture and state of its first registration. For example, motor vehicle that has been registered and used above three months at exporter’s country with odometer reading above 3000 miles is entitled to 10% deductions from ex- factory price more than one year,but not above two years usage is entitled to 20% deductions from ex- factory price and four years usage is entitled to 50% deduction etc. But due to e-valuation or e-invoicing policy of CBN,NCS is no longer complying with its own law.

The ex- factory price given to importers of second- hand motor vehicles is now more than the transaction value of such used motor vehicles. This calls for legal interpretation.

It is to be gleaned from the preceding paragraph that vehicles from 7 years or above of registration and usage at exporter’s country may pay little or no duty on the ground of age and usage abroad. Now when you underline benchmarking matrix and anywhere the goods are sold viz- a-viz the transaction value in the exporter’s country they don’t mean the same thing. The benchmarking, what is benchmarking? Benchmarking is a standard to measure,that is what benchmark is. Matrix is outcome. What is the outcome of the measurement? It is an offer to the world,not even a contract. What the Nigerian Customs Service has done, is that they have gone back to International Data Evaluation Account Reporting (IDERA). They use open market system that is the price of the goods in the open market to appraise duty. That is what they have gone to do. And that is a contravention of Act No.20 of 2003, by the virtue of which Nigeria domesticated GATT principle on valuation .You can’t just amend an act of the National Assembly. So it’s a problem. The General Manager(GM) of PTML lamented over this, when he put the nation on alert that most cargoes that are supposed to come here, Nigerian banks now smuggle them to neighboring countries since the inception of the e-valuation and e- invoicing. If we try and they do not listen to us, we will go to court, because we are losing money, in fact, everything. Let me tell you, the price of any commodity is determined by the landing cost of that commodity. What I’m saying in essence is that prices of commodities in the open market are fixed at the ports and the border stations. Because the importer or the exporter will at the end of the day come up with a landing cost of any cargo. And he will add his profit .There is also non-compliance to allowable deduction of what the agent call age rebate on second hand vehicles. It is there in their law, in custom notice 30, that for every year used vehicles that is 7 years to 10 years is duty free. But customs have swept the law under the carpet. We are going to excavate some laws,and present to government, so that they will know the world over is talking about trade facilitation. The challenges of what brought about the issue of using arbitrary basis to determine value or to appraise customs duty is because of the revenue target given to customs.So they do whatever they want to do, anything possible to meet that target,to the detriment of Nigerians.

I know of fact that in 1st April,2022,NCS,migrated from old version of ECOWAS Common External Tariff (CET), to the new version covering 2022 to 2026 in tandem with World Customs Organisation( WCO )five years review of nomenclature.

Among our members, there are people that were bringing in containers. But today, they are second hand car dealers. Is that a progress? That is no progress because of deficiency in policies.

You talked about your association taking the duo of CBN and the NCS to court. What is your association’s reason or reasons?

Yes, we might sue them jointly and severally for non compliance with Article 7 of World Trade Organization (WTO) General Agreement on Trade and Tariff(GATT) which the Federal Government of Nigeria acceded to in 1997 and subsequently domesticated by Act no 20 of 2003, which expressly provides transaction value as basic price for customs duty appraisal and non – implementation of CEMA Notice 30 paragraph 5.,which provides for allowable deductions from ex- factory prize or basic prize of used motor vehicles.

Therefore it is in recognition of act 7 of WTO(GATT) principles on customs valuation ,that the NCS as an implementing agency migrated from the International Data Evaluating Reporting and Accounting (IDERA) concepts to the Automated System of Customs Data concept in 1998.

IDERA, and Brussels definition of value are the same on the ground that each is based on positive,not on an open market price for customs duty appraisal, which had no over ridding effect on act 7 of WTO/ GATT) principles being later in age and which has become a law by the virtue of Act 20 of 2003 ,which expressly provides transaction value price of the cargo under valuation at exporter’s country of origin, authenticated by combined certificate of value and origin( CCVO) as the basic price for customs duty assessment.

Therefore, the NCS and the CBN must share in the blame for the recent increase in smuggling, which has implications on federal revenue generation and job insecurity along the supply chain.

MMS PLUS NG – Maritime, Aviation, Business, Oil and Gas News Online Newspaper with coverage in Maritime, Oil and Gas, Aviation, Power and Energy as well as Financial News

MMS PLUS NG – Maritime, Aviation, Business, Oil and Gas News Online Newspaper with coverage in Maritime, Oil and Gas, Aviation, Power and Energy as well as Financial News