Capital market experts have rated the country’s democratic regime as one that has failed to create a competitive edge for the domestic investment market.

Capital market experts have rated the country’s democratic regime as one that has failed to create a competitive edge for the domestic investment market.

Assessing Nigeria’s unbroken democracy since 1999, the stakeholders argued that the era delivered less than expected in terms of stimulating growth. They said the application of democratic practice has been below par.

Vice President of Highcap Securities Limited, David Adonri, said Nigeria has suffered three severe recessions within the past 22 years, noting that the economy is largely import-dependent.

Adonri said the parlous state of Nigeria’s infrastructure reflects inappropriate macroeconomic policies.

He noted that the economy is impacted negatively by social factors such as inequitable political organisations, dysfunctional institutions, insecurity and poor leadership. He said the market has found it difficult to contribute meaningfully to economic development since 2008.

According to him, only appropriate macroeconomic policies can drive the economy and impact the capital market positively. He argued that when the economic prospect is bright with growing gross domestic product (GDP).

“Economic gloom leads to a flight of financial assets to safety. In the past 22 years, the yields on debt instruments have persistently surpassed that of equities, indicating that the Nigerian economy has suffered more distress. A recent attempt to forcefully close the yield gap between equities and debt pushed inflation into a galloping mode.

“The capital market is a financing mechanism in aid of production of goods and services. It responds to fiscal policies which affect production. Multiple taxes levied on the production economy and the capital market has been a disincentive to capital formation in the economy,” he said.

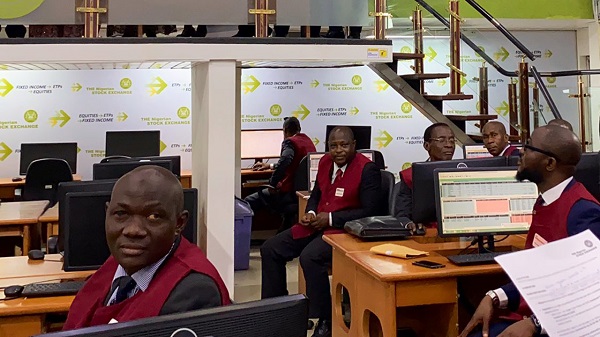

A professor of capital market at the Nasarawa State University, Uche Uwaleke, affirmed that Nigeria has made remarkable progress in capital market development in the last 22, citing the recent demutualisation of the exchange and the creation of asset classes in addition to equities and bonds.

He said market infrastructure has been modernised and strengthened with the platforms for over-the-counter trading namely the NASD and FMDQ now functional, including three commodity exchanges namely the Nigeria Commodity Exchange and the Lagos Commodity and Future Exchange as the latest entrant.

However, he pointed out that the journey to making the Nigerian capital market “one of the largest, most liquid, most diversified and most sophisticated emerging markets by 2025” as envisaged in the 10-year Capital Market Master Plan seems remote despite the giant strides.

This is because he said, the market is still relatively shallow and concentrated and yet to be suitably enabled to support Nigeria’s economic priorities.

According to him, the flagship securities exchange, the Nigerian Stock Exchange, is small compared to major international exchanges, considering its capitalization which is about N20 trillion.

He rated the figure low when compared to the Johannesburg Stock Exchange (JSE) with equities capitalization of over $1 trillion representing over 280 per cent of South Africa’s GDP and over 380 listed companies.

Uwaleke argued that the current size of the capital market with less than 20 per cent of the country’s GDP constrains its role in national economic development.

“Market liquidity as measured by trading volume and turnover is comparatively low and the issuer base is not well-diversified. In other words, industry composition in the stock market is concentrated in a few sectors namely consumer goods (especially Nestle and Nigerian Breweries) and industrial goods (driven by Dangote Cement) and, of recent, telecoms,” he said.

According to him, the International Oil Companies are not listed on the stock exchange while market performance remains tied to the apron-string of foreign investors who often dictate the pace of market activity thereby exposing the market to external shocks.

Going forward, Uwaleke said the government can facilitate growth and development of the market by reducing transaction costs through the removal of VAT and Stamp Duties on capital market transactions which were reinstated some months ago.

He also suggested that the government should grant tax incentives to companies in priority sectors willing to list on the stock exchange as well as rewarding already listed firms through government patronage and preferential business access to encourage listing on the exchange.

Additionally, he urged the government to ensure that the tax regime in the Finance Act should be such that it would give some preferential treatment to quoted companies to make a listing on the stock exchange more attractive.

“Getting more listings especially from companies in the telecoms, agriculture, power, oil and gas sectors will make for transparency through observance of financial disclosure requirements which the stock exchange requires with the potential of affecting government revenue positively.”

President of Standard Shareholders Association, Godwin Anono said the expenditure profile of government in the past 22years has mainly been recurrent without meeting the infrastructural needs of the economy.

He pointed out that the desire for diversification of the economy from crude oil and elimination of import dependence had remained a wishful aspiration over the years.

Anono stated that due to a deficiency of engineering infrastructure, the Nigerian economy lacks the technological base to sustain the productive momentum of industries.

He argued that the capital market is weakened by this situation which affects the profitability of listed companies and depresses the income of investors which ought to be channelled to the market.

MMS PLUS NG – Maritime, Aviation, Business, Oil and Gas News Online Newspaper with coverage in Maritime, Oil and Gas, Aviation, Power and Energy as well as Financial News

MMS PLUS NG – Maritime, Aviation, Business, Oil and Gas News Online Newspaper with coverage in Maritime, Oil and Gas, Aviation, Power and Energy as well as Financial News